The £77,000 habit: how changing your spending can earn money

Takeaway coffees, meal kits, and nights out make life worth living, but they do add up. Learn how much you could earn if you divert everyday expenses into a high-interest savings account.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

A quick takeaway coffee, upgrading your Netflix subscription, or that extra cocktail at brunch can be hard to resist. Indulgences seem harmless at the time.

But if you aren’t careful, spending on small luxuries can drain your savings potential. By making tiny changes to your spending and putting the cost of those items to work instead, you may be surprised at how much you can save.

Thanks to compound interest and high-interest savings accounts, you could earn money when you change your spending habits.

Flagstone collated how much the UK spends on everyday luxuries, revealing the hidden value of your money.

The true cost of your spending

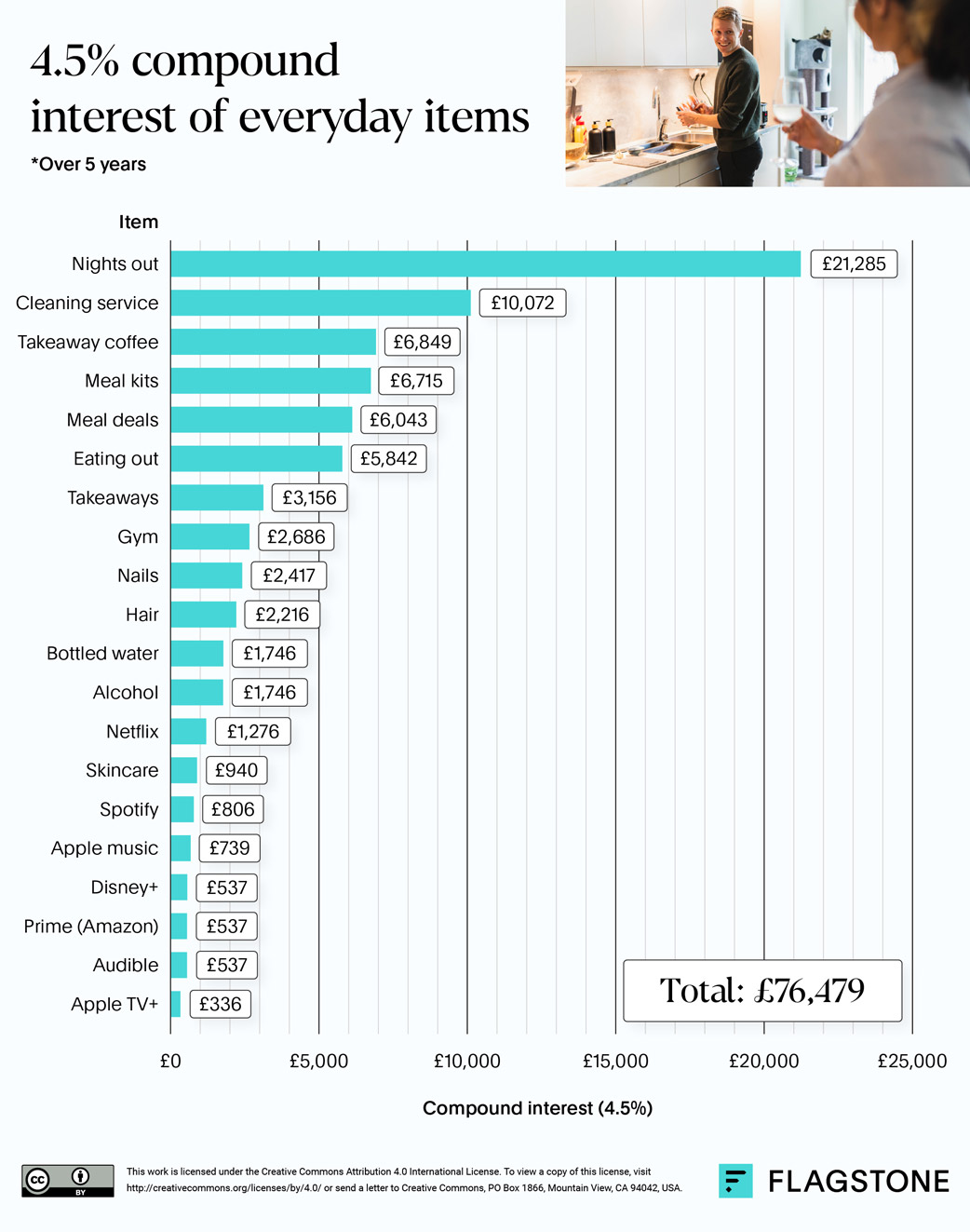

Our research breaks down how much you could earn if you swapped out spending with regular deposits into a five-year fixed savings account at 4.5% AER (Annual Equivalent Rate).

To create this study, we used a list of the most common everyday luxury expenses.

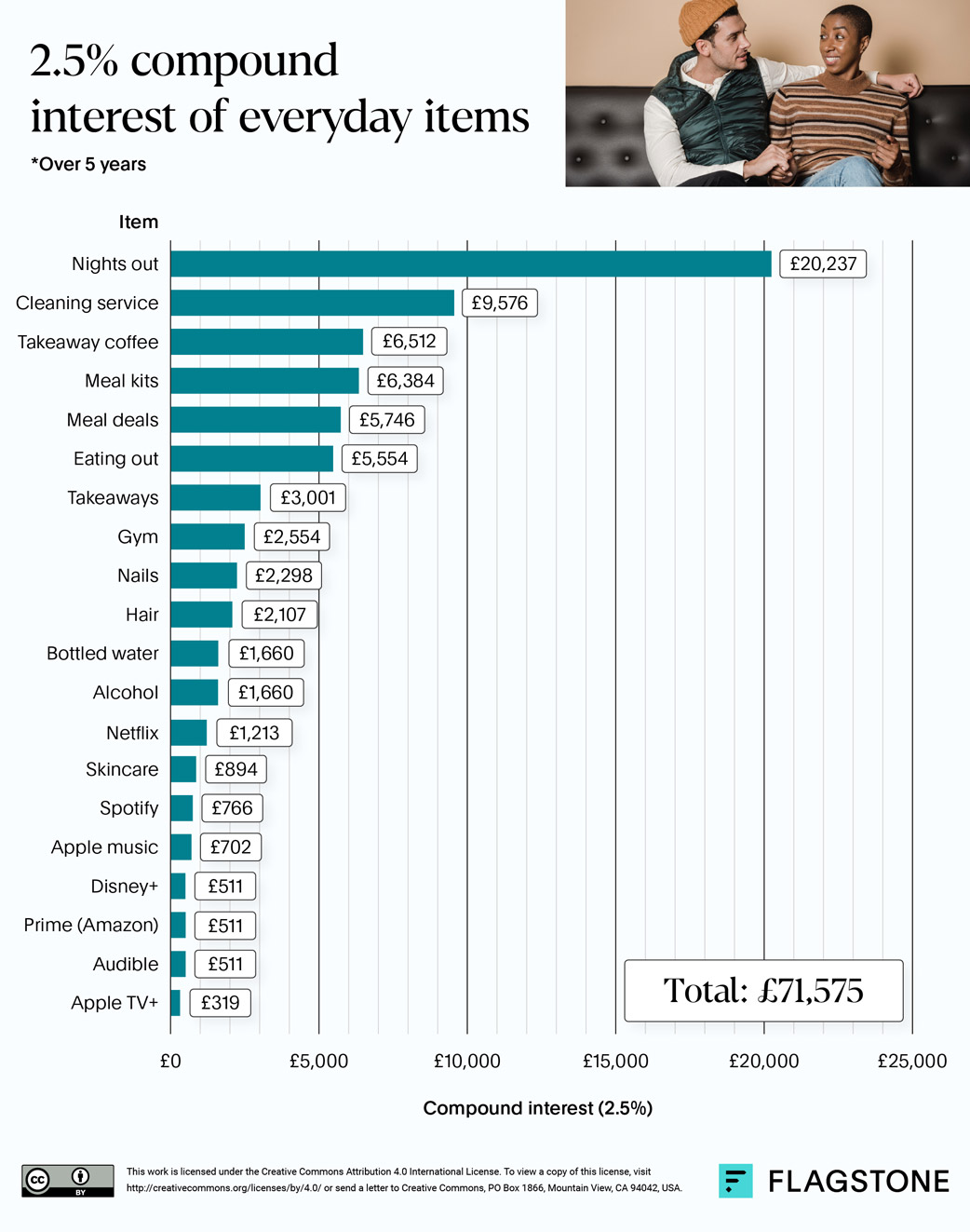

We then determined the average monthly spend per person for each expense. The monthly spend was entered into a compound interest calculator to show how a rate of 2.5% in compound interest would grow a deposit of the same value.

We then ran the same analysis for a high level of interest at 4.5%. Both the interest returned, and the overall balance, were recorded over a five-year period for both interest levels.

Our findings

Our research estimates that you could save a maximum of between £71,575-76,479, depending on your interest rate. The maximum figure relies on saving across all categories.

On average, people in the UK spend £317 per month on small luxuries. Switching spending habits could make a significant difference to your finances.

If you redirected £317 into a high-interest savings account offering 4.5% interest, you could see your savings grow by over £21,000 in just five years.

Even sleeping on smaller sums can impact your earnings. Swapping your £3.40 daily coffee for a homemade brew could free up £102 a month.

Over five years, that adds up to £6,849, with compound interest doing the hard work for you.

Methodology

Our list of the most common everyday luxury expenses is collated from desktop research. We entered the monthly spend for each item into a compound interest calculator.

We then calculated earnings at an interest rate of 2.5% and then at a higher level of 4.5%.

Compound interest was calculated monthly.

We recorded both the interest returned, and the overall balance, over a five-year period for both interest levels.

Maximise your interest with Flagstone

Whether you’re ready to cut back on nights out or want to wake up your savings, Flagstone can help you make your money go further.

Our award-winning platform gives you access to hundreds of high-interest savings accounts from over 60 banks – all in one place, with one login.