How to grow your cash when the base rate falls

The Bank of England has cut the base rate to 3.75%. Discover how the decision affects interest rates on savings accounts – and the practical steps you can take now to protect and grow your cash.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

In a closely watched decision, the Bank of England’s Monetary Policy Committee (MPC) has cut the base rate to 3.75%, its lowest level in almost three years.

The vote drew a clear line between two camps. Five members, including Governor Andrew Bailey, backed a cut to 3.75%, while four preferred to maintain the rate at 4%.

We still think rates are on a gradual path downward. But with every cut we make, how much further we go becomes a closer call.

Why did the Bank of England cut rates?

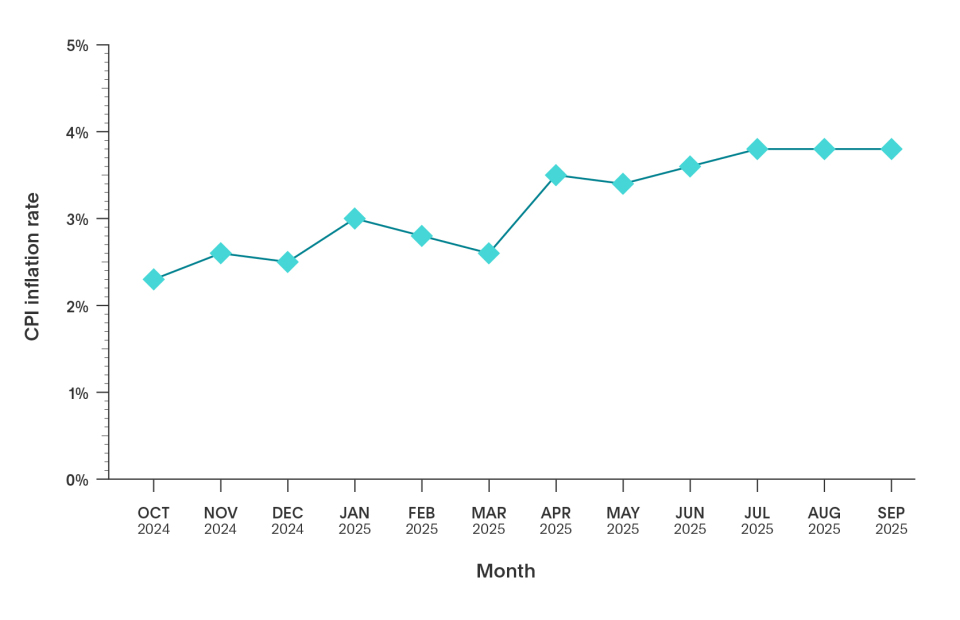

Inflation has started to ease

The latest data from the Office for National Statistics shows inflation fell to 3.2% in November, down from 3.6% in October.

The sharper than expected decline in inflation was an important factor in today’s decision to cut the base rate, offering reassurance that price pressures are easing even as inflation remains above the Bank of England’s 2% target.

The economy continues to face headwinds

Recent data shows the UK economy has struggled to build sustained momentum through much of 2025. Since June, gross domestic product (GDP) has either stalled or contracted, including a 0.1% decrease in the three months to October.

Slowing economic growth plays directly into base rate decisions. When economic activity slows, keeping the base rate high can add further pressure by pushing up borrowing costs for households and businesses. Higher mortgage and loan repayments reduce consumer spending and discourage business investment, increasing the risk that the economy loses further momentum.

How does the base rate affect savings?

When the base rate falls, banks and building societies tend to reduce the interest rates on savings accounts – with variable rates often the first to change.

But there are still plenty of competitive options for savers, particularly on Fixed Rate savings accounts, where locking your cash away for a set term means you’ll often be rewarded with higher interest rates.

Rates on Instant Access savings accounts tend to drop first following a base rate cut. For cash that isn’t required immediately, consider fixing part of your balance to help reduce exposure to rate reductions.

Flagstone's Katie Horne offers guidance for savers following today’s announcement:

‘Many banks had already largely factored in a base rate cut at the MPC meeting and priced it into the savings rates on offer. And with banks keen to meet their end-of-year deposit targets, there should be plenty of products available whose rates beat inflation.’

Using some of the festive period to spring-clean your savings accounts and take advantage of many of the competitive year-end rates available could be time very well spent.

Don’t let your cash get comfortable

Bank of England data shows that over £1tn in UK savings is ‘sleeping’ in low-interest accounts. When cash is left to languish, it’s savers like you who pay the price.

If your cash has been in the same account for several months, it’s worth checking whether the interest rate still reflects current market conditions.

Loyalty to old accounts often doesn’t pay off. Watch Daisy McAndrew explain why in our short video.

Three steps to consider after today’s cut

Here’s a quick and practical checklist to help you take stock of your savings in today’s rate environment.

Frequently asked questions about the Bank of England base rate

What is the Bank of England base rate?

The base rate (also known as the ‘Bank rate’) is the UK’s most important interest rate. It’s set by the Bank of England’s Monetary Policy Committee and is primarily used to control inflation. Read our guide to learn more.

What is the base rate today?

The base rate is currently 3.75%.

How does the base rate affect cash accounts?

Interest rates on savings accounts often move in the same direction as the base rate, but providers vary the speed and size of changes.

Is the Bank of England base rate likely to fall in 2026?

Economists predict further cuts for 2026 – to as low as 3%, but the pace of base rate cuts is likely to be slower.

Control without complexity

Staying on top of your interest rates doesn’t have to mean juggling multiple banks or spending hours comparing options. That’s where Flagstone comes in.

With access to hundreds of savings accounts from over 65 banks, you can compare, switch, and track savings performance. All in one platform, with one password.

Understanding financial terminology

Bank of England base rate announcements can often be jargon heavy. To make things simpler, we’ve created a savings glossary that explains key financial terms in plain English, so you can feel more confident when it comes to managing your money.