How to protect and grow your cash while the base rate is on hold

The Bank of England has held the base rate at 3.75%. Learn how this decision affects your savings, and what you can do today to ensure your money isn’t missing opportunities to grow.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

In a knife-edge decision, the Bank of England’s Monetary Policy Committee (MPC) has voted to hold the base rate at 3.75%.

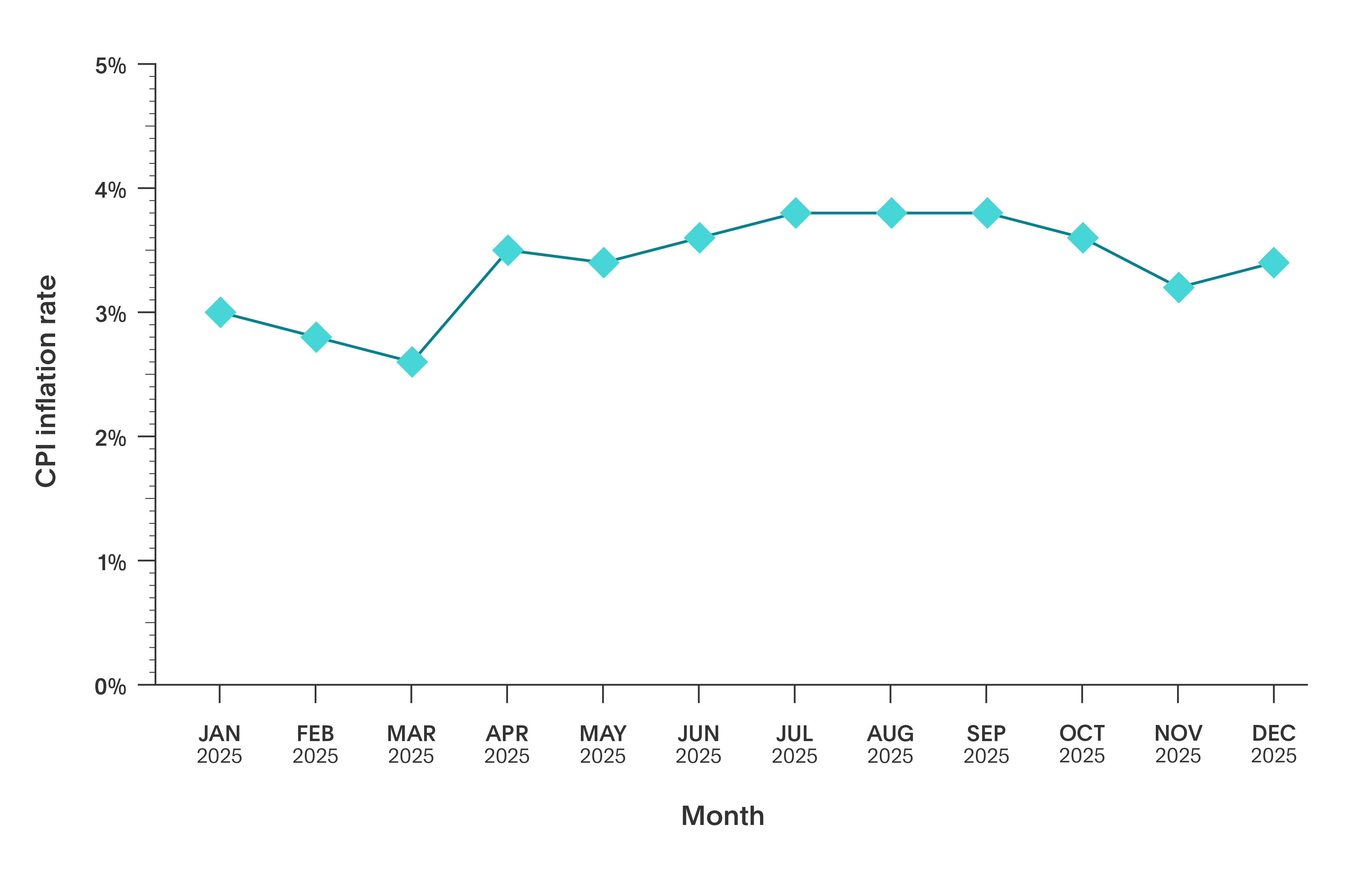

The decision comes after inflation jumped to 3.4% in December, up from 3.2% in November, slightly above forecasts.

Today’s vote wasn’t unanimous. Five members, including Governor Andrew Bailey, voted to leave the base rate unchanged, while four members advocated for a cut to 3.5%.

We now think that inflation will fall back to around 2% by the spring. That's good news. We need to make sure that inflation stays there, so we've held rates unchanged at 3.75% today. All going well, there should be scope for some further reduction in the bank rate this year.

Why did the Bank of England hold the base rate?

At the heart of this decision sits inflation.

While inflation has fallen a long way from its 2023 peak, it remains above the Bank’s 2% target. Cutting rates too early risks reigniting inflation – something the MPC is keen to avoid after the past few years of tightening.

Instead, the MPC has chosen to wait. Holding rates gives policymakers time to assess whether inflation is easing in a sustained way, rather than responding to a single data point.

What does today’s decision mean for your money?

With rates on hold for another six weeks, this pause gives you an opportunity to check whether your cash is still earning competitive returns.

Katie Horne, savings expert at Flagstone, shares her view:

‘Average easy access savings rates are already well below inflation, and the latest inflation jump has only widened that gap.’

Savers aren’t powerless, though. A flurry of market-topping rates has captured attention recently. These are outliers compared with what’s typical in the current market, and they’re unlikely to stay that high forever.

‘That said, there are still plenty of competitive rates on offer that are holding up well, remain easily accessible, and can help savvy savers earn inflation-beating returns on their hard-earned cash.

‘Three in five savings accounts available via Flagstone currently beat inflation, even at today’s elevated level.’

Why a pause is a prompt to review your cash

When rates are on hold, urgency can fade. But periods of pause often reward those who stay engaged. Here’s a quick and practical checklist to help you take stock of your savings in today’s rate environment.

Could you be earning more from your savings?

Loyalty to old accounts often doesn’t pay off, as many don’t offer competitive rates. Switching to more competitive accounts can make a meaningful difference to the returns on your savings.

That’s where Flagstone comes in.

Our platform gives you a simple, secure way to access hundreds of savings accounts from over 65 banks. You can easily compare, switch, and track the performance of your cash – all in one platform, with one password.

What’s the outlook for the base rate in 2026?

Most commentary still points to gradual cuts over 2026, but the pace depends on how quickly inflation cools.

If the economy and inflation evolve as expected, the Bank has signalled there may be scope for further rate cuts in late spring. But, for now, policy remains firmly data-dependent.

Understanding financial terminology

Bank of England base rate announcements can often be jargon heavy. To make things simpler, we’ve created a savings glossary that explains key financial terms in plain English, so you can feel more confident when it comes to managing your money.