How savers can benefit from the base rate hold

The Bank of England has held the base rate at 4%. Learn what drove the decision and how you can take advantage of the pause before any future cuts.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

In a much-anticipated decision, the Bank of England’s Monetary Policy Committee (MPC) has voted to hold the base rate at 4% for the second month in a row. Today’s decision came with more uncertainty than usual, with some economists expecting a cut.

The MPC was also a house divided. In a tight vote, five members, including Andrew Bailey, took a cautious stance, opting to hold the base rate at 4%. The remaining four advocated for a cut, voting to reduce the base rate to 3.75%.

We held interest rates at 4% today. We still think rates are on a gradual path downwards, but we need to be sure that inflation is on track to return to our 2% target before we cut them again.

Why has the Bank of England held the base rate?

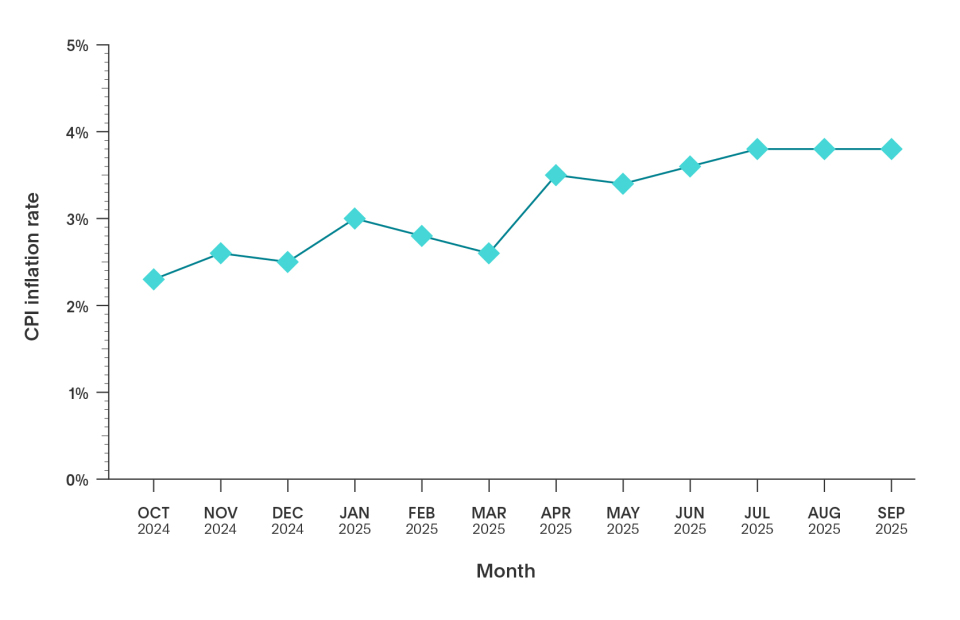

Inflation is easing but it’s still uncomfortably high – currently sitting at 3.8%. That’s almost double the Bank’s 2% target. In the minutes of the meeting, Bailey signalled that the Bank would wait for firmer proof that inflation is cooling before making moves on the base rate.

On top of that, major fiscal decisions are looming. The upcoming Autumn Budget on 26 November could change the outlook for inflation and borrowing. Chancellor Rachel Reeves is hoping fiscal discipline and efforts to bear down on costs will help pave the way for interest rate reductions in the months ahead.

Reacting to the Bank's decision, Reeves said the latest forecast ‘shows that inflation is due to fall faster than previously predicted’.

Flagstone’s Claire Jones offers guidance for savers following today’s announcement.

Savers would be wise to focus on what they can control – and managing their savings is one of them. Whether that means locking in a competitive fixed rate or simply moving idle cash into a higher-yielding account, taking action now can bring some certainty to an otherwise unpredictable environment.

The base rate is on pause – your savings shouldn’t be

Did you know that most of us could be earning much more interest from our savings? That’s the reality of the UK savings market. Over £1tn in cash sits idle in low-interest accounts across the country. Could some of it be yours?

With rates holding steady for another six weeks, it’s a good time to review your savings strategy before possible future cuts.

Watch our short video to learn how to make the most of your money.

When will the Bank of England cut the base rate?

Some experts say a cut could come as soon as December, while others take a more cautious view – expecting the base rate to remain steady until April 2026.

The path ahead remains uncertain, with several factors likely to influence the timing of any change, including:

- inflation moving closer to the Bank’s 2% target

- slow economic growth and rising unemployment

- the outcome of the upcoming Autumn Budget

The timing of any cut will depend on how these pressures play out over the months ahead.

Time to wake up your savings?

It’s not hard to find dozens of Fixed Term, Notice, and Instant Access accounts that continue to outpace inflation. But with future cuts forecast as early as next month, now’s the time to fine-tune your savings strategy.

That’s where Flagstone comes in.

Our platform gives you access to hundreds of savings accounts from 65+ banks – letting you move your money with intention, so your cash can reach its full potential. All in one platform, with one password.

Discover how to protect and grow your cash today.

Key dates to mark in your calendar

| Date | What's happening? |

| 19 November | The Office for National Statistics will publish October inflation data. |

| 26 November | Chancellor Rachel Reeves will deliver the 2025 Autumn Budget, which could impact personal finances. |

| 18 December | The Bank of England’s MPC will announce its decision on the base rate – the final meeting of 2025. |

Understanding financial terminology

Confused about some of the terminology in the Bank of England updates? Our savings glossary explains key financial terms in plain English, so you can feel confident managing your money.