Last updated: 24 February 2026

The complete guide to Cash ISAs: at a glance

- What do I need to know? Cash ISAs are designed to allow you to grow tax-free savings within annual limits.

- What does it mean for me? Recent changes announced by the UK government have made Cash ISAs more complex, but they can still be a powerful addition to your cash portfolio.

- Why does it matter? Building tax-free savings allows you to maximise your interest, especially if you’re an additional rate taxpayer.

In the UK, there are multiple types of Individual Savings Accounts (ISAs), which allow savers to build up tax-free earnings within annual limits.

According to HMRC, the most popular type of account is the Cash ISA, with 9.94m accounts subscribed to by the end of the 2023/24 tax year.

But the UK government announced a reduction in the allowance for Cash ISAs in the 2025 Autumn Budget. Additionally, there are rules you should follow if you want to transfer an ISA’s balance between accounts without using up your current allowance.

So, how can you decide whether a Cash ISA is right for you?

Source: HMRC

The answer will depend on whether you’re an additional rate taxpayer, and your personal circumstances.

In this complete guide, you’ll gain an understanding of how Cash ISAs work, why they differ from standard savings accounts, and why 2026 is an important year for savers looking to maximise tax-free interest.

You’ll also learn why higher earners can benefit from a savings strategy that includes managing multiple Cash ISA accounts.

How does a Cash ISA work?

Cash ISAs operate like traditional savings accounts in a handful of ways. You fund the account, and your deposits earn a percentage of interest which is added to the balance at regular intervals.

For example, you might get paid interest monthly, or annually, depending on the rules that govern your account.

Unlike a regular savings account, HRMC doesn’t charge you tax on the interest you earn within an ISA. This is whether or not you exceed your Personal Savings Allowance (PSA).

How much can you earn in an ISA?

The amount of interest you’ll earn depends on the account you open. Two accounts at the same bank or financial institution can pay different levels of interest, so it’s important to check the Annual Equivalent Rate (AER). In some accounts, the interest you’re paid can go up or down, which is known as a variable rate.

This is why switching accounts to take advantage of a higher rate can be beneficial, though you must follow the rules to avoid using up your annual ISA allowance twice by mistake (more on this later).

Three reasons Cash ISAs matter for higher earners with over £100,000 in savings

Tax efficiency at scale

Additional rate taxpayers receive no personal savings allowance, which means that any interest you earn outside of an ISA is taxable. But the £20,000 annual ISA limit resets every tax year.

This means that by putting your money into Cash ISAs over multiple years, you can steadily build substantial tax-free savings. There’s some evidence that savers across the UK are already doing this.

HMRC’s recent analysis shows growth in Cash ISA balances between the 2021/22 to the 2023/24 tax years.

The most recent increase in ISA funding was driven by a 67% annual rise in the balances of Cash ISAs. By the end of the 2023/24 tax year, the total amount saved in Cash ISAs reached £69.5bn.

By contrast, the funding of Stocks and Shares ISAs grew by just 10.9% (an increase of £3.1bn) over the same year.

Flexibility and range

The most distinctive element of the Cash ISA is the tax-free status it enjoys, and the rules governing transfers between accounts.

In almost every other way, ISAs operate like regular savings accounts for most savers.

This includes the types of accounts that are available, such as:

- Instant access: you enjoy immediate access to your cash whenever you need it, though you’re often paid less interest. There are typically no penalties for withdrawals.

- Fixed rate: your interest rate is set for an amount of time you agree to upfront, but you lose access to your cash for the duration. If you withdraw before the agreement ends, you may lose your interest or pay a penalty fee.

- Notice accounts: if you want to make a withdrawal, you need to give the financial institution holding your money advanced notice. The notice period varies with each account.

Depending on your savings style, you may find that a portfolio of Cash ISAs and savings accounts is the best way to structure your finances.

This can help you balance predictable returns with higher earnings and tax-free interest.

Multiple ISAs

Since April 2024, it’s been possible to open multiple Cash ISAs within the same year. This can help if you want to structure your savings to get the best possible rates without locking away all your savings in fixed-rate ISAs.

Although this has been possible for a few years, it’s remained inconvenient for most savers. This is because financial institutions usually offer just one Cash ISA, resulting in the need for savers to have multiple passwords and logins to manage their tax-free cash.

Partial transfers to maximise interest and protection

Savings platforms like Flagstone allow users to open and manage multiple savings accounts in one place. This means that you can transfer cash into accounts paying higher interest, depending on the type of accounts you choose to open.

Opening more than one ISA with multiple providers also allows you to increase your level of Financial Services Compensation Scheme (FSCS) protection. This is because the FSCS covers deposits up to £120,000 per person, per financial institution if your bank goes out of business.

So, if you transfer a portion of cash into an account with a new provider, you can protect more of your money.

But there are processes you need to keep in mind if you want to avoid using your allowance by mistake when transferring an existing ISA balance.

Transfer a Cash ISA without losing money

If you’ve been saving into ISAs for a handful of years and have built up significant deposits, you can transfer your balance to a new account without using up your allowance for the current tax year. But it’s essential to follow the correct process to do this.

There are three steps you need to follow to make a successful transfer without losing money:

- Wait for fixed-rate terms to end

- Follow the provider’s process

- Transfer with authorised ISA managers

Once your provider has been notified that they need to make a Cash ISA transfer on your behalf, this should take no more than 15 working days, as specified by government guidelines.

Other types of transfers from different ISAs can take up to 30 calendar days.

How Flagstone simplifies the process

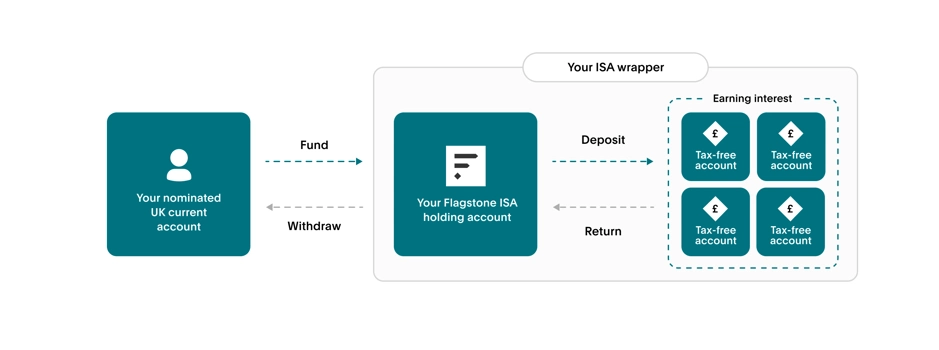

When you withdraw your money from a Cash ISA, it loses its tax-free status. This is because the funds no longer sit within the tax-free wrapper that protects your deposits.

When launched, Flagstone’s Cash ISA will apply the tax-free wrapper to the holding account you initially fund, as well as every other account in the ecosystem. This means you can move your money between ISAs without removing it from the tax-free wrapper.

Are Cash ISAs worth it in 2026?

Yes, depending on your circumstances Cash ISAs can still be worthwhile, especially in 2026 because the reduction in the allowance only comes into effect in 2027.

Cash ISAs will still remain advantageous for most savers even after the reduction, because you can continue to grow tax-free savings every year.

Cash ISA changes in 2027

On 06 April 2027, savers below the age of 65 will have a reduction in their annual Cash ISA allowance to £12,000.

You can use the remaining £8,000 annual allowance for other types of accounts, like Stocks and Shares ISAs, though it’s worth considering whether you want to invest money if your intention is to build your savings.

Consider speaking with a financial adviser if you’re unsure how your personal circumstances might affect your finances.

Frequently asked questions about Cash ISAs

How much can I put in a Cash ISA?

Before 06 April 2027 you can deposit a maximum of £20,000 in a Cash ISA. After that date, savers under 65 years old will only be allowed to deposit £12,000 annually into Cash ISAs.

Can I put in £20,000 every year in an ISA?

Yes. Your allowance resets at the start of the new tax year. This is why it can be a good idea to use your allowance consistently over multiple years, increasing your tax-free interest gradually over time.

What is the maximum amount you can have in an ISA?

Provided you don’t exceed your annual allowance every year, there’s no official limit to the amount you can hold in an ISA. This is because when your allowance resets, you can continue to fund an account you held the year before.

By using your ISA allowance over a handful of years, you can build up a substantial tax-free balance. You can then transfer your balance into a savings platform to access more competitive rates of interest.

If you choose to do this, remember to follow the process for transferring your ISA to avoid using up your allowance for the current tax year.

How safe is your money in an ISA?

ISAs are usually FSCS protected, which means you’re reimbursed up to £120,000 per person, per financial institution if the bank holding your cash goes out of business.

You can expand your protection by opening multiple accounts, which is why savers with significant deposits often use savings platforms like Flagstone.

Cash ISAs: an essential addition to a savings portfolio

Despite upcoming reductions in the annual Cash ISA allowance, these accounts still represent a unique opportunity for savers to build tax-free interest. For higher earners that don’t receive a personal savings allowance, they can offer a vital means to grow your wealth every year.

For savers that have been using their ISA allowances consistently, savings platforms provide a new way to maximise their earning potential while minimising admin.

Build a high-interest savings portfolio with Flagstone

Flagstone's savings platform gives you access to high interest accounts from 65+ banks.

All in one platform, with one login.