Flagstone study reveals the UK’s top priorities after inheriting money

Our new research shows the financial decisions the public would make if they received a large inheritance sum. Discover how much of their windfall they would save, invest, or spend.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

Over half of people in the UK expect to inherit money in the next 20 years in the Great Wealth Transfer, but what would they do with it?

We surveyed 2,000 UK adults to see if they’d prioritise buying property, paying debts, saving, investing, or gifting. Discover whether someone’s age, where they live, or how much they earn influences their decisions.

How would the public use their inheritance?

Buying a property

Almost one in four respondents (24%) said they would prioritise putting inheritance money toward buying a home, rather than saving, investing, or gifting. This highlights the difficulty of achieving home ownership in the UK without external financial support.

This trend is strongest among people aged 35-44 (28%) and similar for 25-34-year-olds and 45-54-year-olds (both 25%).

Buying a home in the UK is expensive: the average property in England costs about 7.9 times people’s disposable income. For younger demographics, the priority is often buying a first home after renting or living with parents. Older generations may be more inclined to invest inheritance in a second home or buy-to-let property.

For some families, passing on wealth through property is also a way to manage Inheritance Tax.

Our research aligns with broader savings trends, with ‘helping children buy a home’ identified as a top savings goal for many parents. In a market where affordability is stretched and tax rules are tightening, property offers value today and a way to pass wealth on tomorrow.

Paying off debts

Paying off debts is the second-biggest priority for using an inheritance.

Respondents aged 45-54 are the most likely to use inherited money to pay off their debts (28%), compared with just 16% of over-55s.

Government figures show that 58% of 45-54-year-olds hold consumer credit, which helps explain why this age group prioritises repayments over risk.

Nationwide, 84% of adults carry some form of borrowing yet only one in five people say they would use an inheritance to clear it, reinforcing how strongly buying property dominates people’s financial ambitions.

Saving money

With forecasts pointing to slower global economic growth, it’s unsurprising that many respondents see saving an inheritance as a safe choice – economic uncertainty often encourages people to hold on to cash.

Young people aged 16-24 are significantly more likely to put their inheritance in a savings account (29%), compared with only 12% of 25-34-year-olds. The majority would choose to buy a property (25%) or pay off debts (22%) first.

While saving is often seen as the safest option, standard current accounts don’t always offer strong returns. High-interest savings accounts are one way people can earn more on their money, with balances of up to £120,000 protected under the Financial Services Compensation Scheme (FSCS).

Investing for the future

Only one in ten respondents said they would prioritise investing their inheritance, but certain income groups buck the trend. Among higher earners (those on salaries above £75,000), 35% say investment is their top priority. In comparison, only 8% of those earning between £35,001 and £45,000 (close to the UK average salary of £37,430) would do the same.

Men are also more likely to invest than women (17% vs. 11%), reflecting the enduring gender investment gap.

Younger adults show a greater appetite for risk: 22% of 25-34-year-olds would invest rather than keeping money in a savings account.

This confidence aligns with wider research. An FCA study found two-thirds of young investors make investment decisions within 24 hours, often driven by fear of missing out and social media influence.

Yet investing in stocks and shares doesn’t guarantee greater returns, as share prices can fluctuate. By comparison, Fixed Term savings accounts provide a guaranteed level of interest on your money for a set period, paid monthly or annually.

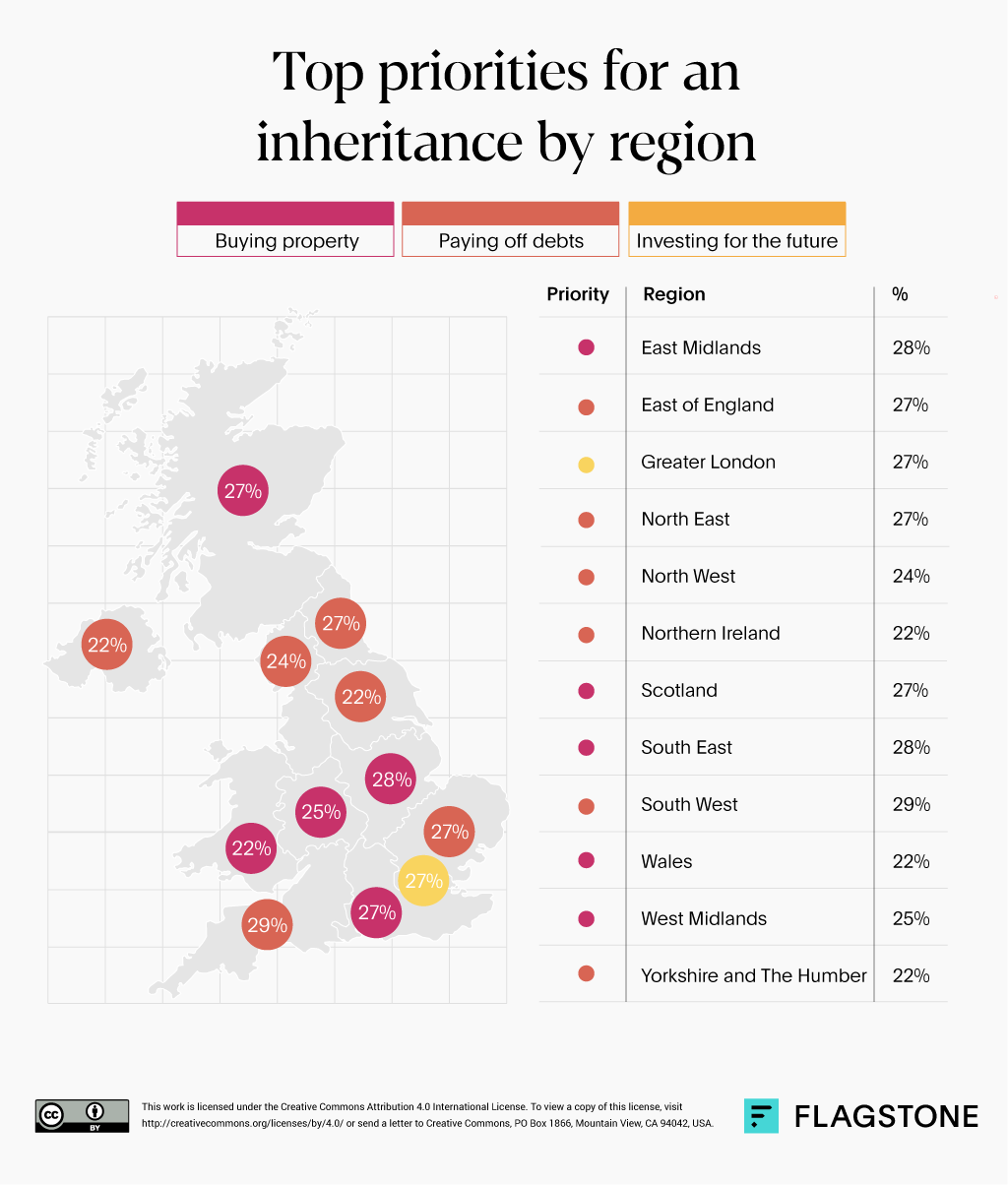

Where you live influences how you'd use an inheritance

Our research shows clear geographical differences when it comes to whether people would spend, save, or invest inherited money.

Property is the top goal across the UK, but it’s especially strong in the East Midlands (28%), South East (28%), and Scotland (27%), where residents are most likely to put inheritance toward a home.

In contrast, only 20% of people living in the North East would do the same. Paying off debts is the leading priority (27%).

While the UK public is generally risk-averse, Greater London is the outlier. There, 27% would invest for the future, making it the UK’s most risk-tolerant region.

Londoners earn almost £20,000 more than people in the UK’s lowest-paid areas, but with the nation’s steepest property prices, many still see investing as a more achievable way to grow wealth than buying a home.

Would the public seek financial advice for their inheritance?

Younger generations are more likely to seek financial advice when inheriting a large sum of money. 82% of 25–34-year-olds say they would, compared with just 54% of those over-55.

Unsurprisingly, income also plays a role. Among those earning more than £75,000, 80% say they would hire a Financial Adviser. That compares with 63% of those on £15,000-£25,000 and 56% of those earning under £15,000.

Citizens Advice recommends seeking qualified advice when handling a lump sum and ensuring any Financial Adviser is FCA-registered.

Grow and protect your inheritance with Flagstone

Received an inheritance? Flagstone can help you make the most of it by earning competitive compound interest.

Our award-winning savings platform gives you access to hundreds of high-interest accounts from over 65 banks – all in one place, with a single login.

Methodology

The research was conducted by Censuswide on behalf of Flagstone, with 2,000 adults in the UK in August 2025.

Survey participants were asked:

- What, if anything, would be your first priority if you inherited a large sum of money? (approximately £500,000)

- How would you divide the money among saving, investing, spending, and charitable giving?

- How likely, if at all, are you to seek professional financial advice before making major decisions about your inheritance/a financial windfall?

- What, if anything, best describes your current financial mindset?