How much is the UK really saving for its children?

The UK is saving more than you might think for the next generation. Flagstone commissioned research to find out which areas are the most invested in their dependents’ future, and how much they’re saving.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

UK savers are expected to transfer £7tn between generations by 2050 as part of the ‘Great Wealth Transfer’. The concept of ‘giving while living’ is allowing baby boomers to pass their wealth onto generation X and millennials – helping to reduce the amount of tax they owe.

The older generation has been able to grow their savings by living longer and building wealth through their properties, investments, and pensions. But will the next generation be able to do the same?

We conducted a new survey to discover exactly how much this generation of parents is saving for their children, with some interesting results.

How much does the UK save for its children?

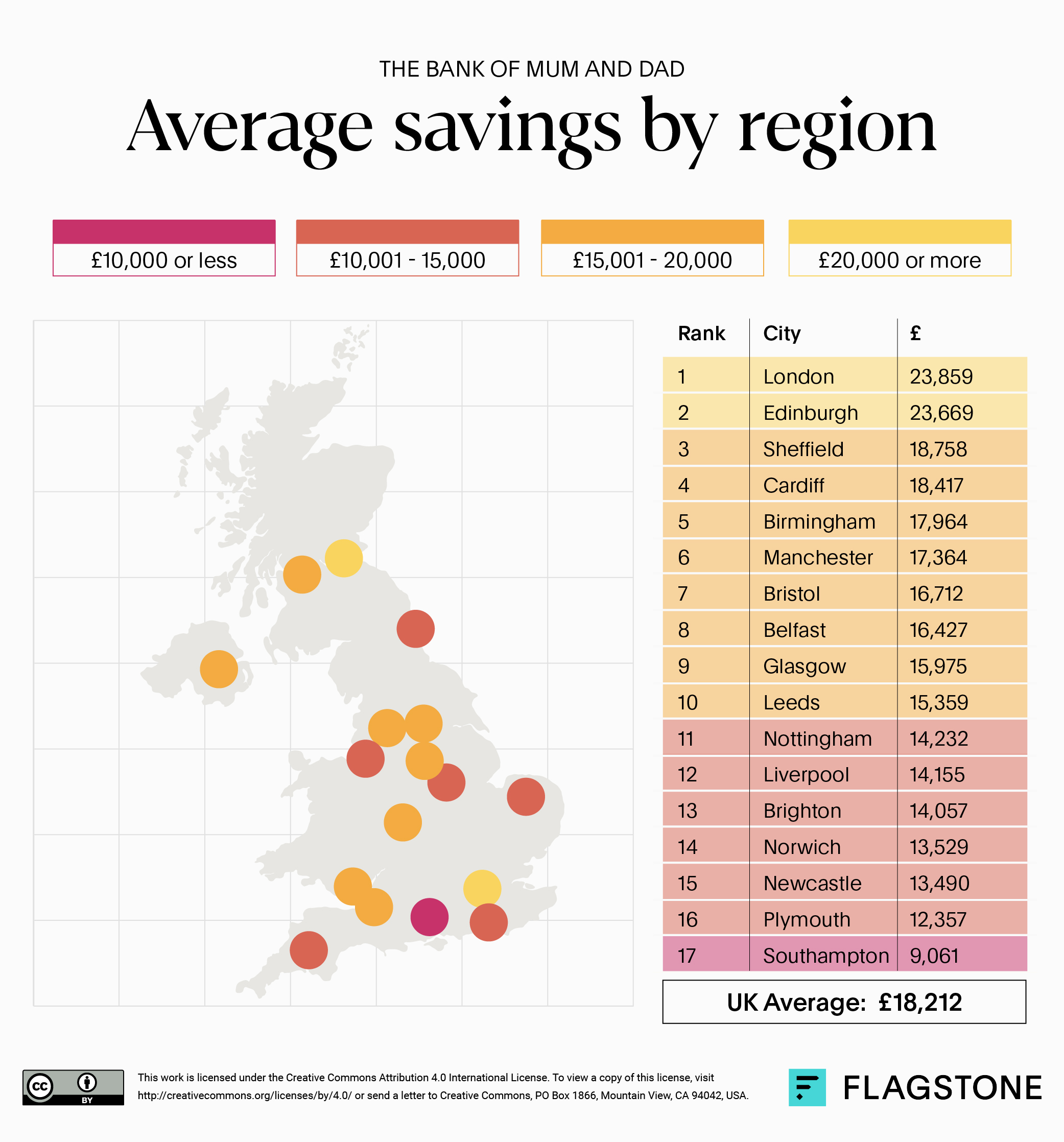

Our study shows UK parents save £18,212.49 on average for their dependents.

Most parents who are saving set aside between £5,000 to £9,999 (21.3%) – the most commonly reported range. The second most common savings amount is £40,000 to £49,999, although only 10.0% of parents nationwide have saved this much.

What are parents saving for?

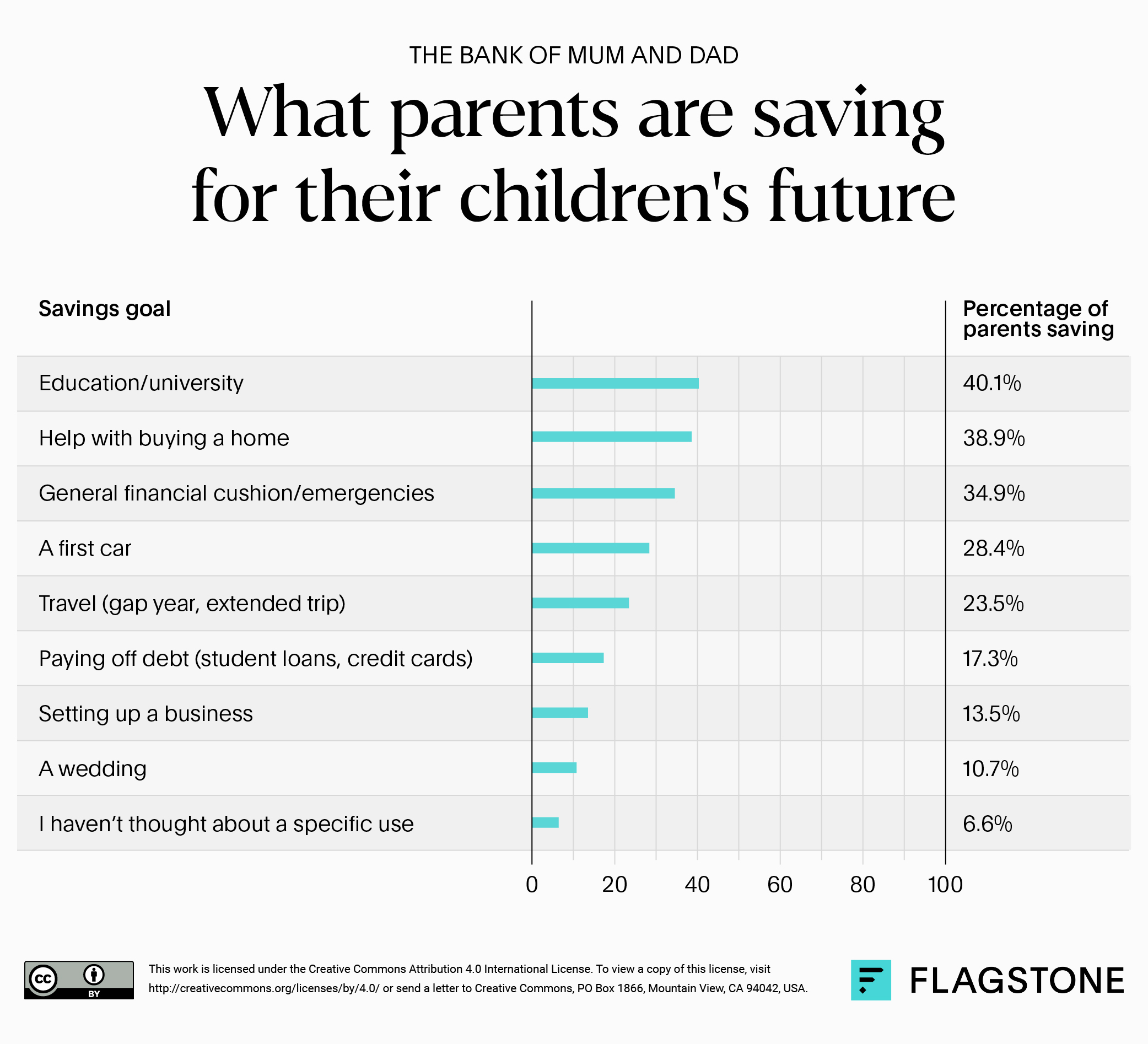

For 40.1% of UK parents, these savings will go towards education or university. That’s why over a third (34.9%) plan to hand it over when their children reach 18 and higher education begins.

This is perhaps not surprising, as it's predicted that university fees in England will surpass £10,000 by 2029-30, due to ongoing plans to raise them in line with inflation.

The second biggest savings goal for parents is to help their children onto the property ladder (38.9%). This likely reflects the increase in house prices, which have risen 1.4% since last year. The average house price in the UK is £268,400 (as of May 2025).

A best-kept secret?

Interestingly, over half of respondents would not tell their children they’re saving for them (52.4%).

Of this percentage:

- 27.8% said this was because their children were currently too young to understand

- 13.9% said that they wanted it to be a surprise

- 10.4% said they wanted their children to save for themselves first

Not all parents are as secretive, though. 47.6% admitted to being open with their children about their savings.

Of this percentage:

- 15.4% said their children knew exactly how much they were saving

- 32.1% said their children knew they were saving for them, but not how much

This is positive, and studies show that 92% of UK parents now talk more about finances with their children.

Building generational wealth is as much about growing your own wealth to pass on to the next generation, as it is about teaching them the skills to preserve and protect it.

Which UK cities save the most for their children?

- When broken down by city, London parents save the most on average (£23,859.23).

- Edinburgh parents are second, saving £23,668.67.

- Sheffield (£18,758.03), Cardiff (£18,416.71), and Birmingham (£17,964.11) complete the top five.

Which UK cities save the least for their children?

- The city which saves the least is Southampton, where parents put away an average of £9,061.24 for their children.

- This is followed by Plymouth parents, who save, on average, £12,357.33.

- Newcastle (£13,489.84), Norwich (£13,528.99), and Brighton (£14,056.61) complete the bottom five.

Give your savings – and your children – the best start with Flagstone

Whether it’s for university, a first home, or just a head start in life, your savings can go further with Flagstone.

Maximise your savings with access to exclusive rates from 65+ banks – all in one secure platform, with one password.

Explore smarter ways to save for your child’s future, today.

Methodology

The research was conducted by Censuswide, with 2,000 parents in the UK in May 2025.