Last updated: 13 May 2025

No one likes uncertainty – especially when it comes to their money. But every investment comes with risk. That’s the trade-off for growth. Some risks are unavoidable. Others can be managed – or avoided altogether with the right approach.

Whether you’re just getting started with investing or reviewing a long-standing portfolio, this guide will help you understand the biggest risks to your investments, and how to reduce them.

In this guide, you’ll learn:

• what investment risk means

• the most common types of risk and how they affect you

• four strategies to reduce investment risk

What is investment risk?

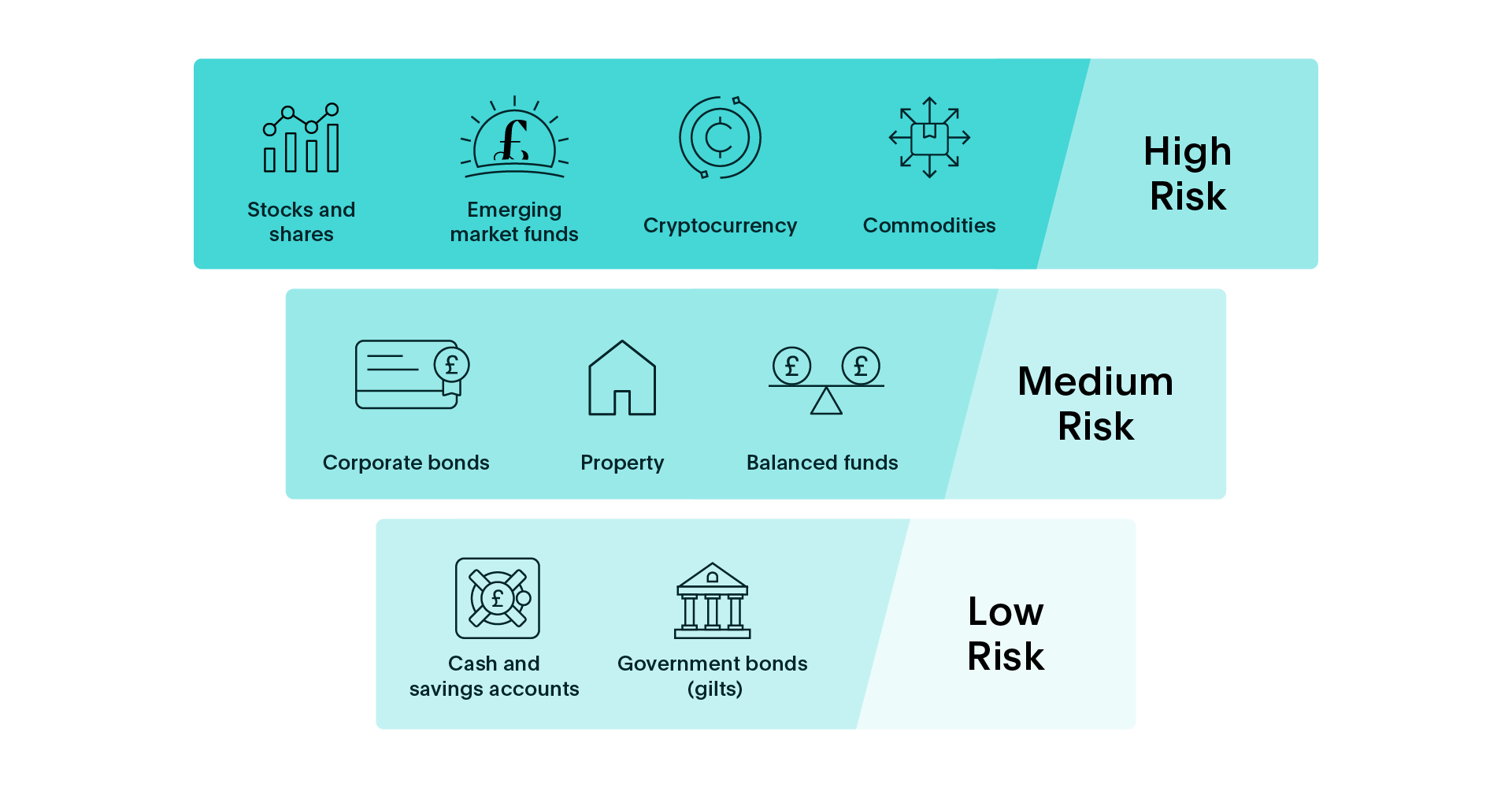

Investment risk refers to the possibility of an investment falling in value. Investments that have a higher level of risk (like stocks) offer greater potential for long-term returns, but with more short-term ups and downs.

Lower-risk options (like cash and bonds) better protect your wealth. While they may offer more limited growth, they still play a valuable role in a balanced portfolio, especially during periods of volatility or high interest rates.

Understanding your own risk tolerance

How much are you willing to lose before you feel the urge to pull out? Would you ride out a dip or move your money the moment the headlines turn negative? Your answers matter.

Risk tolerance varies from person to person. It’s shaped by your goals, your timeline, and your financial situation. Some people can stomach sharp losses if the potential returns are higher. Others would rather sleep soundly at night, even if that means earning a little less.

There’s no right answer. But knowing where you sit on the scale helps you build a portfolio that works for you.

Here’s how different asset types stack up:

Common types of investment risks

1. Market risk

This is the risk that your investments will fall in value due to economic changes or events that affect the entire financial market – known as systematic risk. Here are four common examples:

| Type of market risk | What it means |

| Currency risk | When exchange rates change, the value of your overseas investments can go up or down. This matters if you own foreign assets or do business in other currencies – profits and losses can become unpredictable. |

| Equity risk | This is the risk that share prices will fall. If you invest in stocks, there’s always a chance their value might drop – or that dividend payments will be lower than expected (or not paid at all). |

| Interest rate risk |

This is the risk that changes in interest rates will reduce the value of certain investments – particularly fixed-rate bonds. When rates rise, older bonds paying lower interest become less attractive, so their market value tends to fall. This matters if you need to sell before maturity, as you might not get back what you paid. For cash savers, rate changes can also mean the difference between a good return and a poor one – especially if your money sits idle in a low-rate account while better options are available. |

| Commodity risk | This applies if you invest in commodities, like oil, metals, or agricultural goods – or funds linked to them. Prices can swing sharply due to global events, inflation, or political instability. That volatility can affect the value of your investment and make future returns harder to predict. |

2. Inflation risk

Inflation pushes up prices – and if your investments don’t keep pace, your money loses value in real terms.

Say you’re earning 2% interest, but inflation is running at 4%. On paper, your savings are growing. But in practice, they’re falling behind.

Fixed-interest investments, like bonds or some savings accounts, are especially exposed, because their returns stay the same while your cost of living rises. What looked like a solid return five years ago might not stretch as far today.

But there’s another side to the story.

If inflation falls, interest rates could follow. And when that happens, the rates available today might start to look more attractive. Locking in a higher return now could be a smart move.

Inflation is a risk. But with the right timing, it can also be a window of opportunity.

3. Liquidity risk

This is the risk that you may not be able to sell your investments quickly or at a fair price. With liquidity comes the possibility that you’ll have to accept a price you don’t want. This risk applies mostly to investors who hold illiquid assets – you may not be able to sell them for cash without losing value. They’re often difficult to sell quickly because of a lack of investors or buyers. Examples include property, classic cars, and rare art.

How to reduce investment risk

Consider the following strategies to shield your investments:

1. Diversify your investments

Don’t put all your eggs in one economy. Or one industry. Or one CEO’s hands.

Diversification means spreading your money across a mix of assets, sectors, and regions. Stocks can offer long-term growth. Bonds can provide steady returns with lower volatility. And cash – when placed in the right accounts – can offer stability and competitive interest.

A well-diversified portfolio helps smooth out the bumps. It gives your money room to grow, while reducing the risk that any single setback will knock you off course.

2. Regularly rebalance your portfolio

Portfolios shift over time. Certain investments grow faster than others – and that changes the balance. For example, you might start with 60% in stocks and 40% in bonds. But if stocks rise sharply, they could become a much bigger share of your portfolio than you planned.

Rebalancing brings things back in line. It’s a way to keep your investments working towards your goals.

Check your portfolio once or twice a year. If one part has grown faster than the rest, consider moving things around to restore your original balance – or update it if your goals have changed.

Learn more about what to consider when rebalancing your investment portfolio.

3. Take a long-term investment approach

Markets don’t move in straight lines. They rise, they fall – sometimes sharply. Right now, we’re in a period of increased volatility. That can be unsettling, especially if you're watching your portfolio drop in value.

But short-term volatility isn’t unusual – and it doesn’t mean your long-term goals are out of reach. History shows that markets tend to recover over time, often stronger than before. The key is not to act out of panic.

Selling at the wrong moment can turn a temporary dip into a permanent loss. A long-term approach means staying focused on the bigger picture, even when the headlines look bleak.

4. Seek the expertise of a Financial Adviser

For help managing your portfolio's risk, a Financial Adviser's expertise can be valuable. They can help you:

- build a diversified portfolio

- rebalance your assets

- guide you in identifying where your investments exceed your risk tolerance

Make cash part of your strategy

Right now, cash is offering something many investments can’t: stability. And in a high-rate environment, that stability comes with the potential for meaningful returns.

Our cash savings platform gives you access to hundreds of interest rates from over 60 banks. We simplify the process of spreading your cash across different accounts. With just one log in, you can eliminate the hassle of application forms and move money around with ease.

Use our calculator to see how much interest you could be earning, whilst spreading your deposits to maximise FSCS protection.