Bank of England cuts base rate to 4.25% – what it means for your savings

The Bank of England just cut the base rate for the second time this year. Here’s why it happened, what it means for your money, and what savers should do next.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

In what many economists predicted was a ‘done deal’, the Bank of England has just cut the base rate by 25 basis points – to 4.25%.

Markets had priced in an almost 100% chance of this move, with inflation easing and concerns building around Donald Trump’s trade tariffs.

But the Monetary Policy Committee (MPC) was a house divided. Five members of the MPC, including Andrew Bailey, voted to lower the base rate by 25 basis points. Two members preferred a bolder move, voting to reduce the base rate to 4%. The remaining two took a more cautious stance, opting to hold at 4.5%.

The past few weeks have shown how unpredictable the global economy can be. That's why we need to stick to a gradual and careful approach to further rate cuts.

Why did the Bank of England cut rates?

Inflation is slowing

The Bank of England is responsible for keeping inflation low and stable – aiming for a target of 2%, set by the Government.

UK inflation fell faster than expected in March, down to 2.6%. It's expected to climb again this summer – potentially hitting 3.7% – before falling later in the year.

But the path ahead looks bumpy. Global events – like trade disputes and rising energy costs – could shift things quickly.

Global uncertainty is growing

The US trade tariffs are likely to weigh on UK growth in the months ahead.

Andrew Bailey, Governor of the Bank of England, recently said the UK could face a ‘growth shock’ as a result of Trump’s trade policies. The International Monetary Fund recently lowered its UK growth forecast for 2025, from 1.6% to 1.1%, in response to the impact of the tariffs.

Cutting the base rate now is one way to support the economy – by making it cheaper for businesses to borrow and invest, and easing pressure on households.

What does the base rate cut mean for savers?

The base rate is falling. And savings rates are likely to follow.

That doesn’t mean strong rates are off the table – but they may not stick around for long. If your savings are sitting in the same account they were six months ago, it could be worth reviewing your current rate – and exploring what else is available.

There are still attractive rates across the market – particularly on Fixed Term accounts, where you lock your money away for a set period in exchange for a higher return. But some rates have already started to edge down.

Instant access accounts are most vulnerable to early reductions. Savers looking to secure higher rates should consider Fixed Term accounts – especially if they’ve already set aside enough for emergencies.

What is the forecast for interest rates in the UK?

This cut is unlikely to be the last.

While the Bank of England has signalled a cautious approach, many economists expect at least two more cuts before the end of the year – with some predicting even more.

Barclays now forecasts four consecutive cuts, which would bring the base rate down to 3.5% – a level not seen since December 2022.

Time to wake up your savings?

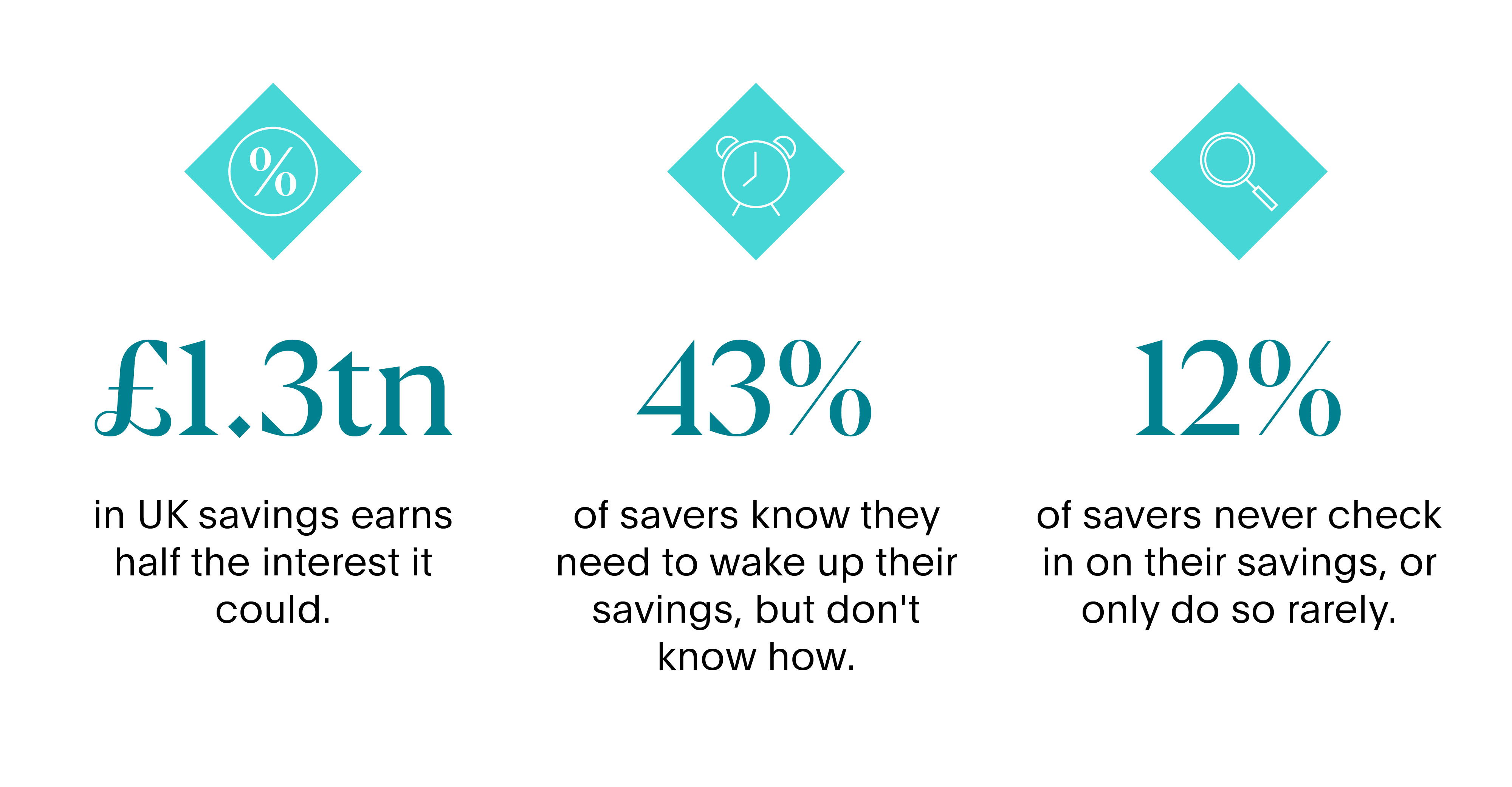

Most of us could be earning more interest from our savings, but money has a habit of staying where it is. The latest data shows that over £1tn sits idle in low-interest accounts across the UK.

If your savings have been standing still, it could be time to check if they’re still pulling their weight. That’s where Flagstone comes in.

A simpler way to manage your savings

Staying on top of your interest rates doesn’t have to mean juggling multiple banks or spending hours comparing options.

With Flagstone, you can access a wide range of savings accounts from over 60 banks – all through one secure platform. Whether you want flexibility or fixed returns, you can find options that suit your goals and move your money in just a few clicks.

Use our interest rate calculator to discover how much interest you could be earning with Flagstone.

When are the Bank of England base rate review dates?

The Bank of England’s MPC meets every six weeks to review the base rate. These are the remaining review dates for 2025:

| Month | Announcement date |

| June | 19 June 2025 |

| August | 7 August 2025 |

| September | 18 September 2025 |

| November | 6 November 2025 |

| December | 18 December 2025 |