How today’s Bank of England rate cut could affect your savings

The Bank of England’s Monetary Policy Committee has cut the base rate to 4%. Find out why it was reduced, what this means for your savings, and what you should do next.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

Bank of England base rate: at a glance

- The Monetary Policy Committee (MPC) cut the base rate to 4% at today’s meeting.

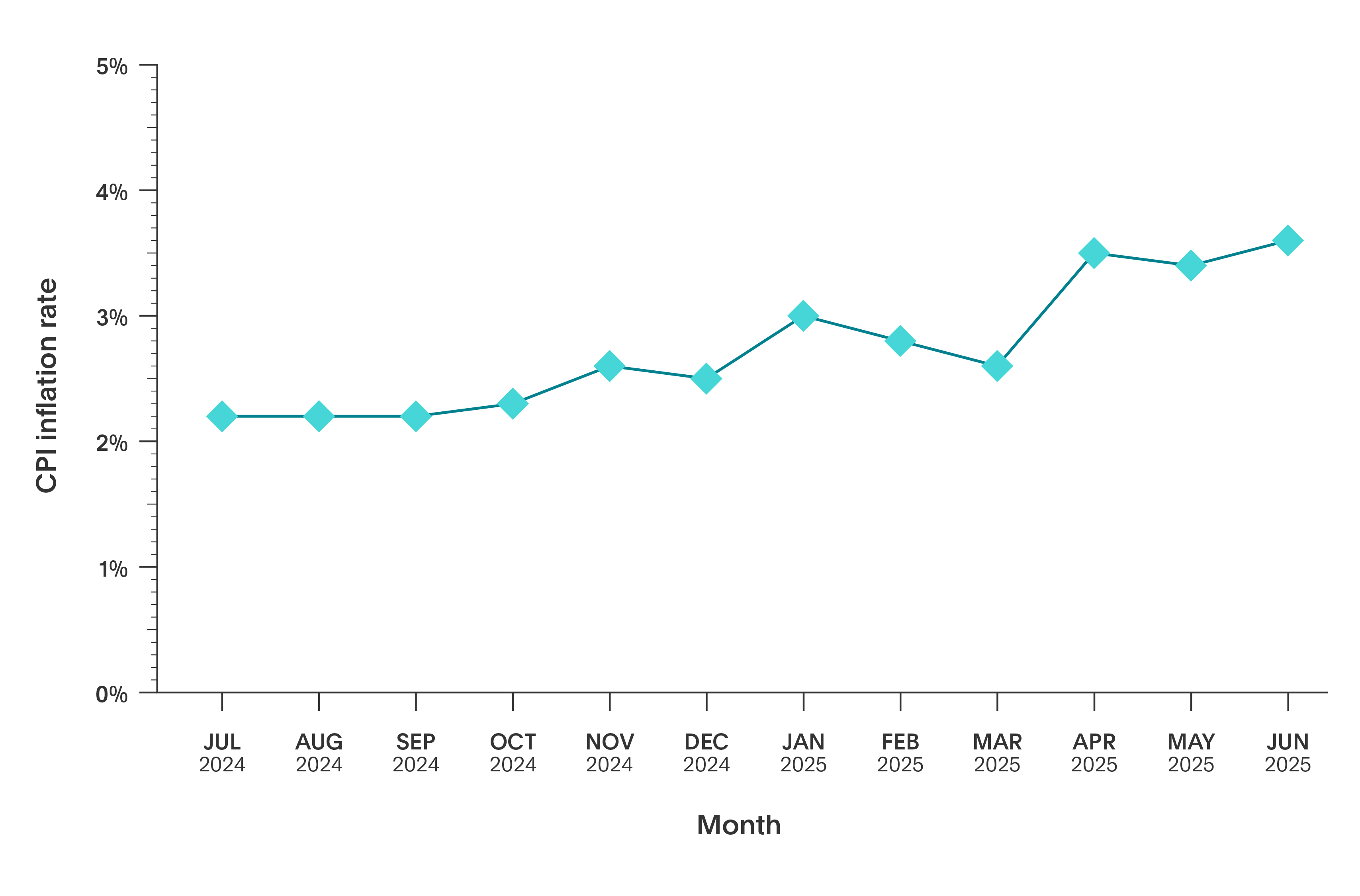

- UK inflation rose to 3.6% in June – up from 3.4% in May.

- A slowing economy and global trade tensions continue to fuel uncertainty.

- Some savings accounts still offer competitive returns – but these could start to dip.

- The next Bank of England base rate decision is on Thursday 18 September 2025.

The Bank of England has cut the base rate again today – reducing it from 4.25% to 4%. This marks the fifth cut since August 2024, as the MPC responds to a slowing economy.

But not all were in favour. The MPC voted by a majority of 5–4 to reduce the base rate.

We’ve cut interest rates today, but it was a finely balanced decision. Interest rates are still on a downward path, but any future rate cuts will need to be made gradually and carefully.

The backdrop to today’s base rate cut

Weak economic growth outweighs inflation concerns

Inflation rose to 3.6% in June, up from 3.4% in May. That’s the highest rate since January 2024 – and well above the Bank of England’s 2% target.

Rising inflation tends to make a rate cut less likely. But the economy shrank by 0.1% in May, and the unemployment rate grew to 4.7%. As a result, pressure has been building on policymakers to ease the strain on households and businesses.

Cutting the base rate can help. It lowers borrowing costs, which encourages spending and investment. That, in turn, supports jobs and economic growth.

Global trade tensions fuel uncertainty

International trade tensions have added further uncertainty.

President Trump recently introduced new import tariffs, which have shaken global markets and sparked fears of slower global growth.

At the May Monetary Policy Press Conference, Governor Andrew Bailey said:

‘New tariffs and elevated trade policy uncertainty weigh on global activity. The US administration has made a series of announcements with significant changes to tariff polices. Volatility in financial markets has accompanied these announcements.’

What does today’s cut mean for interest rates on savings accounts?

Instant Access accounts are often the first to respond to base rate changes. Some interest rates have already started to dip.

If your money is languishing in a low-interest account, especially one earning less than inflation, now’s a good time to explore other options.

In this sort of environment, it pays to fix. Locking in a competitive rate on a Fixed Term account now can help to shield your cash against falling rates.

With inflation above target as the base rate falls again, securing a guaranteed return is increasingly attractive and, for many, a sensible move. Fixed Term savings accounts help savers take action against stubborn inflation and the risk of it eroding real returns over time.

A simpler way to manage your money

If your cash is sitting idle in a low-interest account, now’s your chance to lock in competitive rates before any future cuts.

With Flagstone, you can access a smorgasbord of savings options from over 65 banks – all on one secure platform, with one password. Whether you want flexibility, fixed returns, or a mix of both, you’ll find options that suit your goals.

When are the Bank of England base rate review dates?

The Bank of England’s MPC meets every six weeks to review the base rate. The remaining dates for 2025 are:

- 18 September

- 06 November

- 18 December

The next round of inflation data, published on 20 August, will be key in shaping the Bank’s next move.

When the MPC meets in November, they’ll also share their final quarterly monetary policy report for 2025, indicating the outlook for 2026.

Frequently asked questions about the Bank of England base rate

What is the Bank of England base rate today?

As of 07 August 2025, the base rate is 4%.

Will my savings interest rate drop now that the base rate is 4%?

While not all providers adjust rates right away, future reductions are likely. Instant Access accounts are often the first to reflect base rate changes, followed by Notice and Fixed Term accounts.

Does this affect my current Fixed Term savings account?

No. If you’ve already locked in a fixed rate on your savings account, it won’t change until the maturity date. But if you’re considering a new Fixed Term account, it’s likely that the most competitive rates today will start to fall following the latest base rate cut.

Are more base rate cuts expected this year?

Yes. Another cut is forecast in November, which could take the base rate to 3.75%.

Should I fix or stay flexible with my cash?

This is dependent on your goals and financial circumstances. But it doesn’t have to be one or the other. Many savers use a combination of Fixed Term and Instant Access accounts to keep some money accessible while securing a higher return on the rest.