The Bank of England’s Monetary Policy Committee (MPC) has voted to leave the base rate unchanged at 4% for at least another six weeks. The road ahead looks uncertain, but economists broadly agree on one aspect: rates are unlikely to fall before early 2026.

Today's decision wasn't unanimous, with a 7-2 majority opting to hold the rate at 4% while Swati Dhingra and Alan Taylor preferred a cut to 3.75%.

We held interest rates at 4% today. Although we expect inflation to return to our 2% target, we’re not out of the woods yet so any future cuts will need to be made gradually and carefully.

What spurred today’s decision?

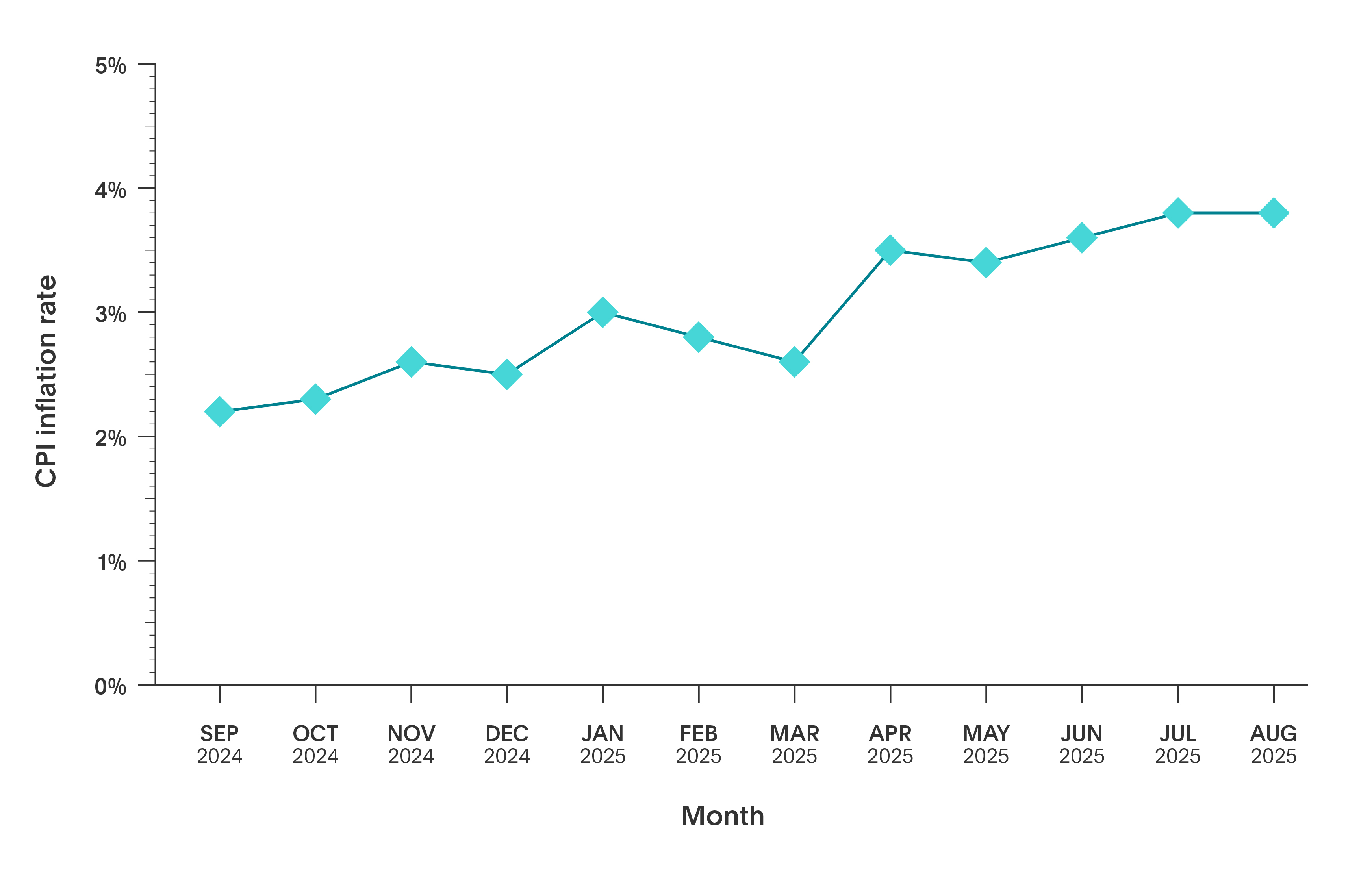

Inflation remains stubborn. The latest data from the Office for National Statistics shows that inflation rose by 3.8% in the 12 months to August, well above the Bank’s 2% target.

At the same time, the economy is softening. GDP grew by 0.7% in the first quarter and 0.3% in the second. Cutting rates now could give economic growth a lift by lowering borrowing costs for households and businesses, which in turn encourages spending and investment. But there’s also a risk inflation will rise further.

In the minutes of the meeting, the MPC emphasised that any future rate reductions will depend on clear evidence of continued disinflation, and said monetary policy is ‘not on a pre-set path.’

The base rate is standing still, but your savings shouldn’t

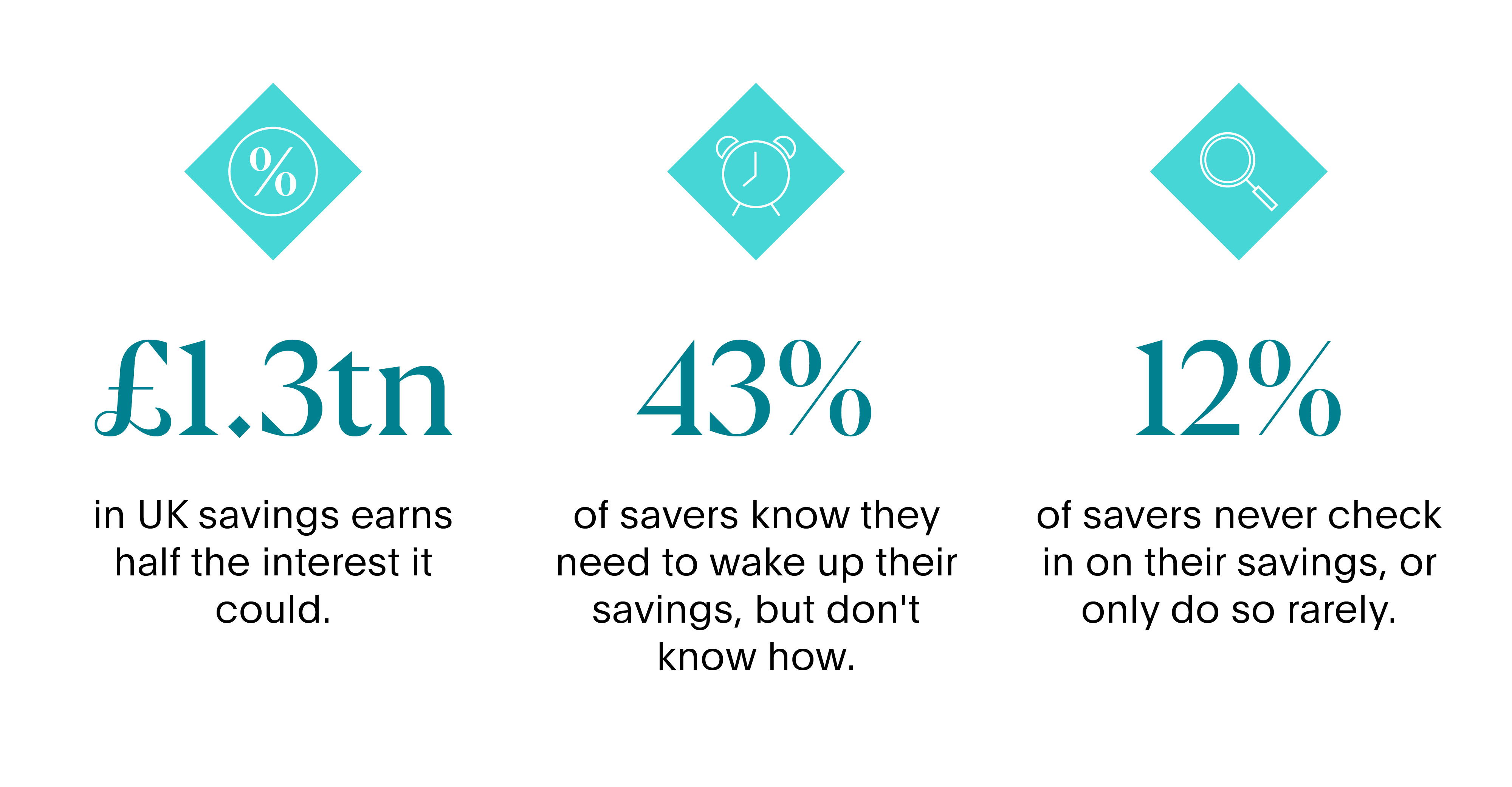

Over £1tn in UK cash is left to languish in low-interest accounts, meaning millions of savers are earning less than they could. A pause in the base rate isn’t a time for inaction. It’s a wake-up call.

Flagstone's Claire Jones shares her perspective on how savers can navigate the current savings landscape.

Fixed Term savings accounts are a saver's best defence against stubborn inflation. Savers would be wise to lock in inflation-beating returns for the longest terms they can manage, allowing them to ride out this tricky climate safe in the knowledge that their money is losing as little in real terms as possible.

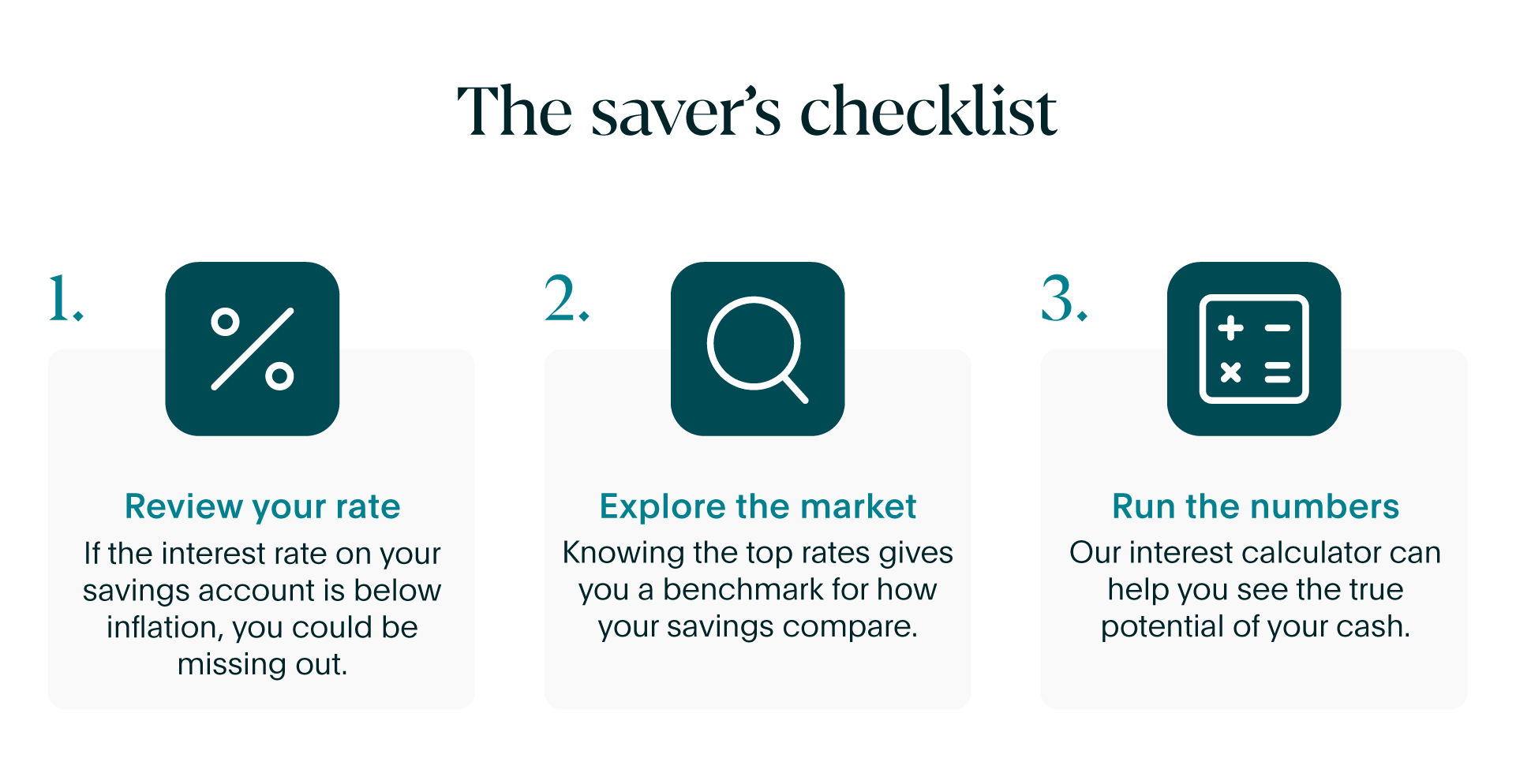

Three simple steps savers should take

Here’s a quick and practical checklist to help you take stock of your savings in today’s rate environment.

Explore ratesCalculate interest

Key dates to mark in your calendar

| Date | What's happening? |

| 22 October | The Office for National Statistics will publish September inflation data. |

| 06 November | The Bank of England’s Monetary Policy Committee will announce its decision on the base rate. |

| 26 November | Chancellor Rachel Reeves will deliver the 2025 Autumn Budget, which could impact personal finances. |

Give your cash the best chance to bloom

It’s not hard to find dozens of Fixed Term, Notice, and Instant Access accounts that continue to outpace inflation, but these rates won’t stick around for long. That’s where Flagstone comes in.

With access to a smorgasbord of savings accounts from over 65 banks, you can compare, switch, and track savings performance – all in one platform, with one password.

Discover how to protect and grow your cash.