Which savings account is right for me?

Savings accounts are a safe and dependable way to protect your cash. But with so many variables, how can you decide which one is right for you?

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

Last updated: 07 February 2025

Think of savings accounts as the Rubik's Cubes of the financial universe. Seemingly simple, yet full of twists and turns beyond interest rates alone. Many investors view savings accounts as a safe and dependable way to protect their cash. But with so many variables, how can you decide which one is right for you?

In this article, we look at eight important factors to consider when selecting a savings account.

1. Define your savings goals

When deciding on your savings strategy, start by identifying your short and long-term goals. What do you want to achieve?

Analyse your income, expenses, debts, and assets. This will provide clarity on where your finances stand and guide how much you can put toward your goals.

Be clear about your desired outcome. This will have the biggest influence on how you decide to divide your cash, whether you’re building an emergency fund or saving for retirement.

2. How often will you withdraw cash?

Know how quickly you’ll be able to access your savings if you ever need to. This means you won't be surprised by any limitations from your provider.

For example, some accounts might limit the number of withdrawals you can make per month. Others might enforce a waiting period before you can access newly deposited funds. Certain accounts might need advance notice for larger withdrawals. Let's look at some examples.

Notice accounts

With a Notice account, you’ll need to tell your bank when you’d like to make a withdrawal. This means you won’t be able to get your cash immediately. Notice accounts are a good way to incentivise saving because you can’t withdraw cash on a whim.

Fixed Term accounts

With a Fixed Term account, you invest your cash at a fixed rate of interest (known as the ‘term’). This means that once you’ve deposited your money, you won’t be able to withdraw it until the term is up.

Higher interest rates tend to require you to part with your cash for longer – whether it's through a Notice or Fixed Term savings account. Consider whether the potential for higher earnings outweighs the need for immediate access to your cash.

3. Pay attention to account fees

Be mindful of account charges that reduce your earnings. Examples include:

- Annual or monthly maintenance fees

- Withdrawal limit fees

- Foreign transaction fees

- Overdraft fees

These can eat into your hard-earned savings and are often automatically deducted from your account. You can avoid many of these by meeting the terms and conditions of your account, which is why it’s important to read the small print.

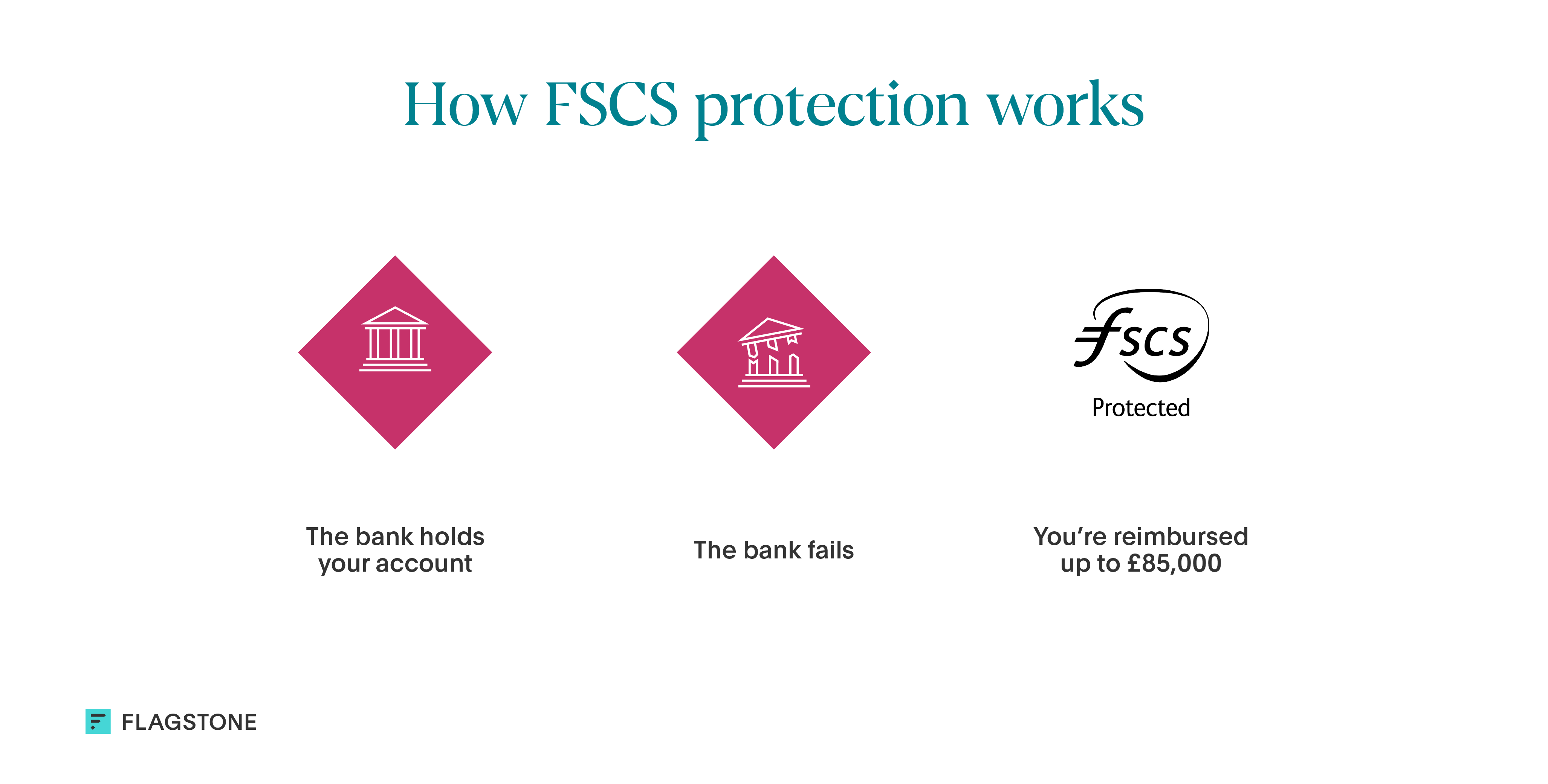

4. Know how to protect your cash

The Financial Services Compensation Scheme (FSCS) has a compensation limit of £85,000 (per client per banking group). So, if you hold an eligible deposit with a UK-authorised bank or building society that fails, the FSCS will compensate you.

If your savings exceed the limit, you can still get FSCS protection by spreading your cash between multiple banks. This strategy prevents you from relying too much on one institution, so you can maximise your income without sacrificing security.

5. Be mindful of the minimum balance

A minimum balance is the lowest amount of money you must have in your account at any time. Dropping below the minimum amount could result in a fee, so it’s worth shopping around for accounts that won’t penalise you, should that happen.

Avoid fees by enabling balance alerts through your bank's notification system (if that’s an option). They might have features that allow you to set up alerts when your balance is low. If maintaining a minimum balance proves challenging, there are accounts out there that don’t enforce this rule.

6. Check if you need a minimum deposit

The minimum deposit needed to open a savings account can vary. Some banks require you to deposit a minimum amount when you open your account. Others let you open your account first and fund it later.

But the advantage of putting a minimum deposit into your account is that you’ll start earning interest straight away.

7. Explore lesser-known banks

Even if a bank is unfamiliar to you, it's worth considering as an option.

Online banks, for example, often provide higher savings rates than high street branches. Not having a physical space means they incur fewer overhead costs, allowing them to offer more competitive rates. Online banks usually provide more sophisticated online and mobile banking features, such as budgeting and financial monitoring, to help you keep track of your money.

The lack of physical branches might not be suitable if you prefer to deal with complex financial matters in person. In addition, online banks also make it difficult to deposit cash as they often use partner ATMs or online check deposits.

Online banks can be a good choice if you value higher interest rates, convenience, and lower fees, but it's important to weigh up what’s best for your individual needs. When considering a lesser-known bank, always do your homework, visit the bank’s website, review websites such as Trustpilot and make sure they’re registered with the Financial Conduct Authority (FCA).

8. Consider a cash savings platform

Does form-filling discourage you from opening new savings accounts?

Many people are turning to cash savings platforms to avoid the admin. These let you:

- open multiple accounts with a single application

- switch money between providers

- get competitive rates with less admin

Platforms charge a fee for this service in exchange for market-leading, exclusive rates. If you prefer convenience and are comfortable with online platforms, these can be a great option.

Save strategically, with Flagstone

When you sign up to Flagstone’s cash savings platform, you get access to hundreds of accounts from 60+ banks, giving your cash ample opportunity to flourish. With one login, you can remove the hassle of filling in multiple application forms and enjoy the ease of moving your money around.

Find out how your can start saving with Flagstone