What is a savings platform?

Opening savings accounts shouldn’t feel like admin. Savings platforms help you earn more interest and protect your deposits – all from one place, with one login.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

Last updated: 30 May 2025

The process of opening new savings accounts is full of checks and roadblocks. Queries and questionnaires. These barriers often prevent time-poor people from moving their cash into high-interest savings accounts.

Instead, deposits languish in low-interest accounts. But savings platforms make it easy to maximise interest on your cash and protect your deposits from the unexpected.

In this article, you’ll learn what savings platforms are, how they work, and why building a cash portfolio can increase your FSCS (Financial Services Compensation Scheme) protection.

What is a savings platform?

A savings platform (also called ‘cash deposit platform’, ‘cash management service’, or ‘savings marketplace’) is an online tool that lets you open and manage multiple savings accounts from multiple banks. All with one application.

Take Flagstone, for example. We partner with 65+ banks to put 300+ savings accounts on a single platform. These include:

This way, you can create an entire cash portfolio in one place, and manage it with one password. Which ultimately makes it easier for you to protect and grow your cash.

How does a savings platform work?

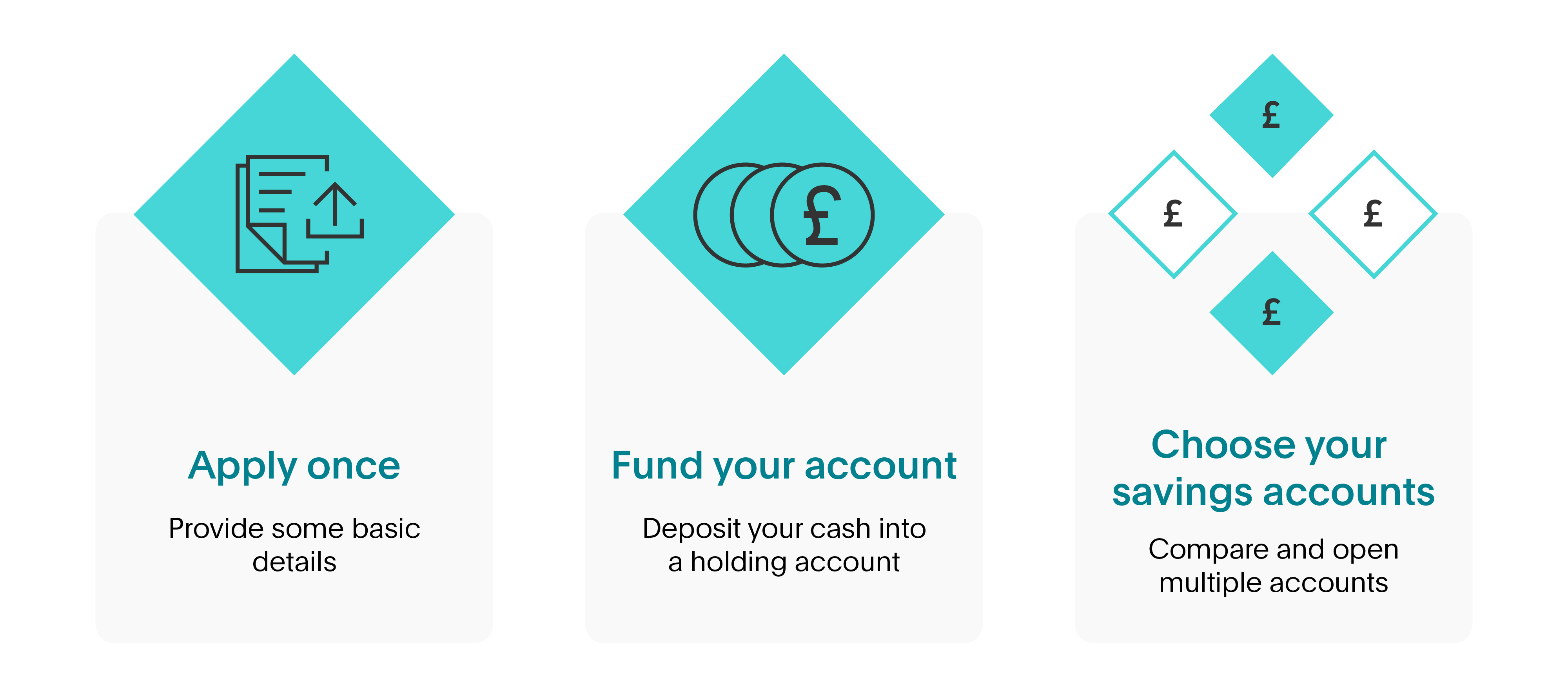

Here’s how a savings platform works in three simple steps:

1. Apply to your chosen savings platform (like Flagstone)

With savings platforms, you only need to complete one application to open as many savings accounts as you like. You’ll need to provide a few basic details, as well as some information about the source of your funds. This helps to keep savings platforms secure, and your cash safe.

2. Fund your account

Most savings platforms will use a ‘holding account’, ‘hub’, or ‘wallet’, which you’ll need to fund once you’ve opened your account. From here, you can deposit into as many savings accounts as you choose.

In Flagstone’s case, your holding account is provided by HSBC, and is FSCS-eligible. Savings platforms don’t make any decisions for you – you’re free to deposit your funds wherever you choose.

3. Choose your savings accounts

Sort, filter, and find the savings accounts that suit your goals. Whether it’s Instant Access, Fixed Term, Notice, or a mix of all three, the choice is yours. Open as many as you like, without filling out multiple applications.

How do savings platforms compare?

There are now a handful of savings platforms available in the UK – each designed to help you manage your savings more efficiently. While they all offer similar core benefits (like opening multiple accounts with one application), they differ in terms of fees, partner banks, returns, and minimum deposit requirements.

Here’s a comparison of some of the most well-known platforms on the market:

| Platform | No. of partner banks | Minimum deposit to join | Platform fees | Top rate: Fixed 6 months (AER) | Top rate: Instant Access (AER) |

| Akoni Cash Management | 20+ | None | Akoni charges a fee of up to 0.25% per deposit. An additional fee of up to 0.20% is deducted from the gross interest by the bank before it’s paid to you. The rate you see is the rate you receive. | 4.16% | 3.95% |

| Bondsmith | 60+ | £1,000 | Bondsmith doesn’t charge any admin or management fees. They receive a share of the interest from the bank, which is deducted before the account is featured on the platform. The rate you see is the rate you receive. | Not available* | 3.47% |

| Flagstone | 65+ | £10,000 | Flagstone doesn't charge any admin or management fees. They receive a share of the interest on each savings account (up to 0.30%). They deduct that share before they feature an account on the platform. The rate you see is the rate you receive. | 4.39% | 4.20% |

| Hargreaves Lansdown Active Savings | 25+ | None | Hargreaves Lansdown doesn’t charge any admin or management fees. They charge the bank, who pay them a percentage fee for every product they have on the platform. | 4.36% | 4.25% |

| Insignis | 45+ | £100,000 | Insignis charges a monthly service fee based on a sliding percentage of your total deposits. This fee is taken from a reserve held in your name. There are no additional management fees. | Insignis don’t publicly display top rates | |

Last updated 30 May 2025.

*You need to be a client to access the full range of rates and terms.

What are the benefits of a savings platform?

1. Effortless process

With a savings platform, opening and managing savings accounts is much easier. As you only need to complete a single application to access every account on the platform, there are fewer barriers to moving your cash. That means higher interest is only ever a couple of clicks away.

2. Exclusive rates

Some savings platforms will use their strong relationships with their bank partners to secure special and exclusive rates. They’ll also send you regular email updates to let you know when new, competitive rates are available.

Can I open several savings accounts?

Most savings platforms let you filter hundreds of savings accounts, to quickly find the right options for you. It might be a Fixed Term account with high interest, or perhaps an Instant Access account for your rainy day fund.

Whatever your plan, these platforms make it easy to find and open several accounts that suit you best. You can also sort the savings accounts on Flagstone by:

- account type

- interest rate

- FSCS protection

- term length (for Fixed Term accounts)

This gives you the flexibility to build a cash portfolio that suits your unique needs.

Does the FSCS cover savings platforms?

Whether you’re managing your own cash, or that of a business, it’s vital your funds are protected. But the FSCS only covers £85,000 per individual per banking group (or £170,000 for joint accounts).

That means you may have to open multiple accounts with different banking groups to protect all your cash.

That would usually require you to complete multiple applications, track maturities in different places, and remember a handful of passwords.

But a savings platform simplifies the entire endeavour, by bringing it all under one roof. You’ll be able to open as many accounts as you need with one application, and manage them all with one password.

An easier way to track and manage your savings accounts

Most savings platforms will have some kind of ‘dashboard’, where you can see a summary of all your savings accounts at a glance. This will usually tell you:

- which savings accounts you have open

- the interest rate they’re earning

- term length (for Fixed Term accounts)

- interest accrued on each account so far

This gives you a snapshot of your cash portfolio, making it easier to manage. It also means that you can move your cash quickly if anything changes (say a rate decreases, or the term ends on a Fixed Term account).

A perspective from Simon Merchant, Flagstone Co-Founder & CEO

Interest rates have rebounded from the lows of years past, and cash is back on the map. But it’s still too complex to move and grow your funds. Every form is an obstacle. Every requirement a roadblock.

Platforms like Flagstone provide the answer. With Flagstone, you can open and manage hundreds of savings accounts from 65+ banks. All in one place, with one password, and a single application.