The opportunity of Fixed Term savings

We explore how interest rates have followed inflation fluctuations, and how current forecasts make Fixed Term savings accounts an attractive choice.

This article is not advice. It is provided for information purposes and should not be treated as a recommendation. Advisers remain responsible for the advice they provide to their clients.

This year, we’ve seen two consecutive reductions in the base rate, and the Bank of England (BoE) has signalled its intention to continue the cuts. Before rates reduce further, clients can secure higher returns with Fixed Term savings accounts. For advisers, that presents an opportunity to stay ahead of the curve, and ensure their clients get maximum value.

Falling rates

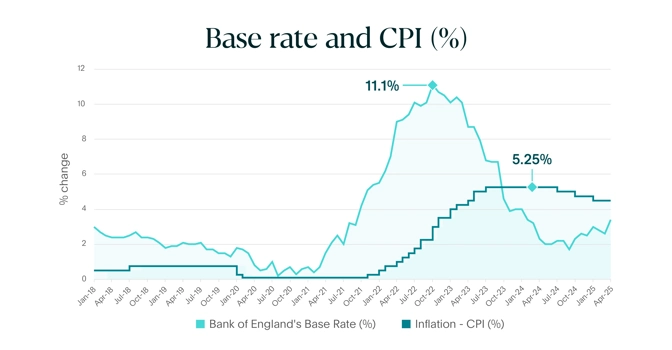

Not long ago, surging inflation dominated the economy. The pandemic shattered supply chains, and the Ukraine conflict sent energy prices soaring. To bring inflation back under control, the BoE raised interest rates to 5.25% in 2023.

It worked – inflation has declined since, prompting corresponding reductions in the base rate. And despite the BoE predicting that inflation will reach 3.7% in 2025, it proceeded with two rate cuts: a 0.25% reduction in January, followed by another one in May.

In its latest Monetary Policy report, the BoE stated their intention to keep the rate cuts coming, while carefully assessing the impact that US tariffs will have on the UK economy.

Growth predictions for 2025 are modest at 1% but more positive in the following years – 1.9% in 2026, 1.8% in 2027, 1.7% in 2028, and 1.8% in 2029. These forecasts show optimism that inflation will be under control soon, allowing the base rate for fall further.

And in our recent poll*, 88% of advisers predicted that the base rate will reduce further by the end of the year.

Rates can change quickly

Clients might naturally think rate reductions will filter through gradually, giving them plenty of time to react. But that’s not always how the market works. Banks sometimes pre-empt the BoE, adjusting their rates early to protect profit margins.

It’s well worth flagging to your clients – especially those looking to make the most out of current savings opportunities. Right now, savers are in a strong position. Inflation has eased over the last few years, and interest rates are still high. It’s clear that now’s the time to snap up the best deals.

Fixed Term doesn’t mean locked away forever

It’s easy to assume clients understand banking terms - but that’s not always true, especially when it comes to savings products. A 2024 study, commissioned by Klarna, shows that younger savers find financial jargon more challenging to understand than a foreign language.

It’s no surprise that some clients shy away from Fixed Term savings, thinking their money will be inaccessible for years.

It might seem obvious, but a quick recap on how Fixed Term accounts work can boost client confidence. With competitive rates available, they’re a strong option for growing cash savings – especially when combined with other savings products.

Flagstone makes saving simple. Our award-winning platform offers a broad range of Fixed Term savings accounts – from one month to seven years – all in one place.

Next, we explore why cash is a valuable part of a savings portfolio in economic uncertainty.

*Flagstone survey with 191 participating advisers, carried out in May 2025.