Why high-interest savings accounts suit low-risk investors

Low-risk investors tend to prioritise assets less likely to lose value. You can never completely eliminate risk, but high-interest savings can offer an appealing alternative to investments in uncertain times.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

While eliminating risk is impossible when it comes to investing, there are steps you can take to mitigate it as a low-risk investor.

Investment strategies like diversification and rebalancing can offer some stability to your portfolio. But if you’re looking for a safer way to grow your money, diverting some of your investments into cash within a high-interest savings account can let you can earn interest while maintaining a strong level of protection against loss.

In this article, you’ll learn why high-interest savings accounts can be one of the lowest risk assets in a financial portfolio.

What does risk tolerance mean?

Your risk tolerance is your willingness to cope with a decline in the value of your investments. If you're evaluating your risk tolerance, consider how comfortable you are with the possibility of your investments losing value.

Risk and reward work hand in hand when it comes to investing. All investments come with a degree of risk, regardless of the type of assets you have. The more risk you take on, the greater potential for a higher return.

Some investors are prepared to sustain losses in pursuit of a market-beating gain in the long-term. Others prefer to play it safe, choosing to settle for lower returns in exchange for more predictable outcomes.

Diversification and rebalancing to lower your risk

If you have a low risk tolerance, there are investment strategies that can help you manage volatile market conditions, maximise gains, and minimise losses.

Spreading your investments across different products and asset classes is known as diversification. By diversifying your investments and allocating a portion to cash, you won’t be relying on just one area to perform well. If your stocks aren’t performing, you can still reap the rewards of your other investments and maintain a safety net.

Another beneficial investment strategy is rebalancing your portfolio. This means buying and selling your assets, or adjusting the weightings of your asset classes and allocation. It encourages you to review the types of investments you hold, ensuring they align with your desired level of risk tolerance and financial goals.

What are other low risk investments and how do they compare to cash?

Some investors choose to prioritise low risk investments at times of economic uncertainty. A handful of the least risky investments you can buy include:

- government or corporate bonds

- index funds

- exchange-traded funds (ETFs)

There are downsides to investing in the above assets. Let’s take a closer look at each in turn.

The downside of bonds

Bonds operate like a loan to businesses or governments. You fund an account, and they pay you interest with a regularity that you both agree to upfront. As such, there is a chance the institution might not pay you back. This is known as ‘defaulting on a debt’.

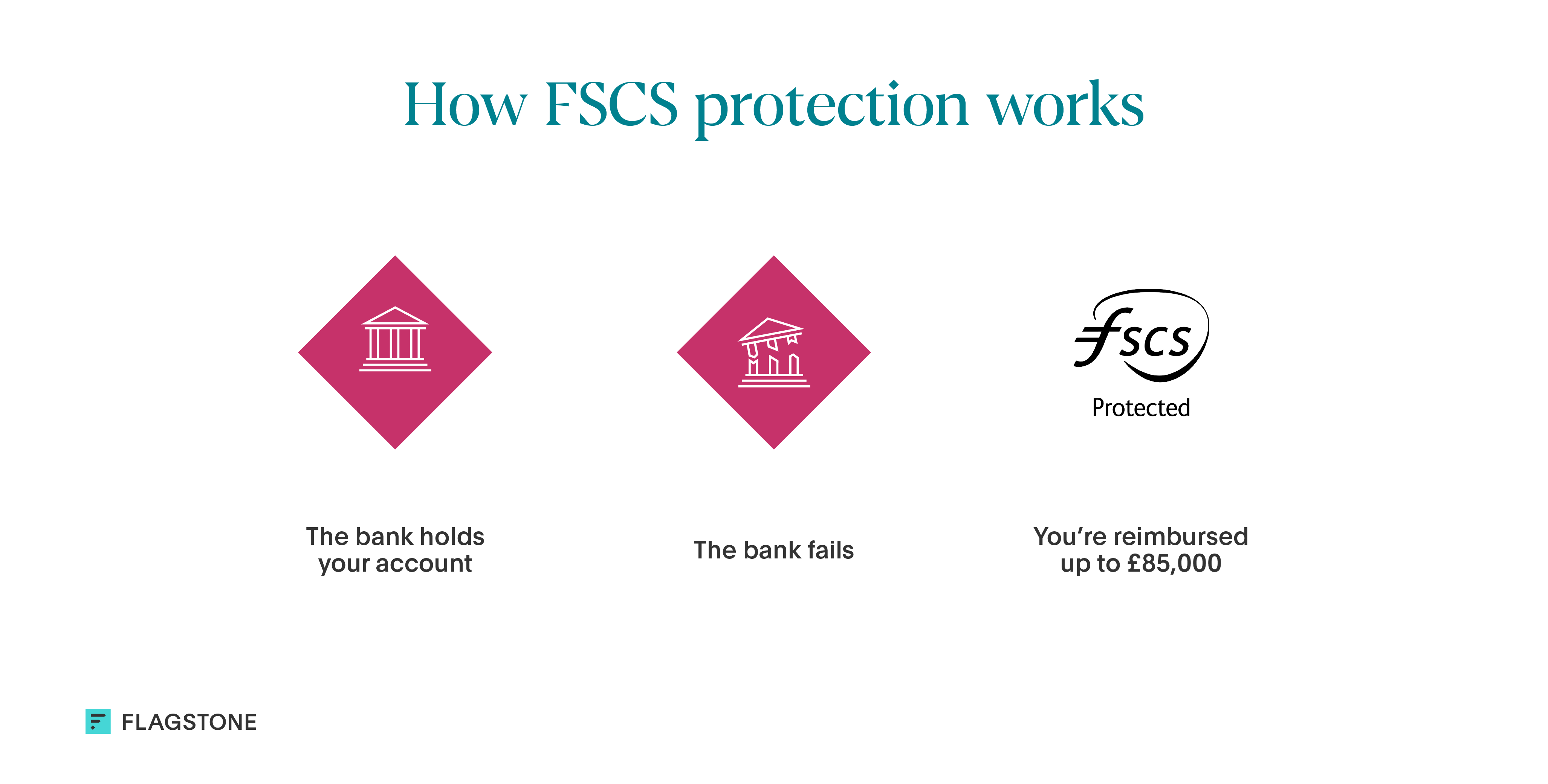

While it’s also possible for banks to go out of business, your deposits can be protected up to a limit of £85,000 per person, per institution if your account has FSCS (Financial Services Compensation Scheme) protection.

You’ll learn more about this later.

The downside of index funds

Index funds track the performance of a market index, which includes a group of companies on the stock market. The indexes are grouped together by the features they have in common. For example, an index might include the largest companies headquartered in the United States (S&P 500).

Index funds are typically lower risk than investing in single companies, as the historical trend has shown that indexes tend to rise over time. But this doesn’t mean they are immune to widespread economic turbulence.

If you need to access your money at the wrong time, you could still make a loss on your investment.

By contrast, cash doesn’t decline in savings accounts provided your interest rate outpaces inflation, and you leave it untouched. The important factor is the rate of growth, which can be either slow or fast depending on the interest you’re paid.

The downside of ETFs

ETFs are similar to index funds. The main difference is that ETFs can track the performance of all kinds of assets, not just an index.

As a result, ETF investors can find themselves with the same downsides as index funds. Additionally, market turbulence can convince some investors to respond emotionally, picking investments based on unrelated factors that can result in an erosion of wealth.

For investors that enjoy selecting a range of assets, there are similar mechanisms that allow you to create a portfolio in cash.

Opening multiple savings accounts allows you to spread your money across financial institutions, without taking on as much risk as investing. Savings platforms like Flagstone let you manage your accounts with one login, making this an easy way to manage your money and scale your returns.

The benefits of high-interest savings accounts

If you’re waiting for an opportune moment to invest in stocks, or you simply want to earn some interest while keeping your cash secure, one or multiple high-interest savings accounts could be a suitable option for you.

Here are some of the benefits of high-interest savings accounts:

FSCS protection

High-interest savings accounts that are regulated by the Financial Conduct Authority (FCA) are protected under FSCS up to a certain amount.

This means should your bank fail, your savings are protected up to £85,000 per person, per financial institution. Just make sure your savings account is both regulated by the FCA and protected under the FSCS before you make a deposit.

Tax-free interest

You can use your Personal Savings Allowance (PSA) to earn tax-free interest up to a certain amount. This allowance amount depends on the rate of income tax you pay. If you’re a higher-rate taxpayer, you can currently earn up to £500 interest tax-free with the PSA.

For more information on how interest works, take a look at our guide to interest rates for savings and investments.

Less risk

Cash is widely considered a ‘safe haven’ asset. This is because it retains protective qualities during a market downturn. Keeping your money in a high-interest savings account is often less risky than investing in other assets (like stocks and shares) and can still provide significant real returns if the rate outpaces inflation.

Interest rates and account features

The type of savings account you choose can affect the interest you earn. For example, a fixed-term account often provides a higher interest rate. It also won't change during the term, so there are no unwanted surprises. But in return for this higher rate, the withdrawals you’re allowed to make are limited.

With an instant-access account there are no limits to the withdrawals and transfers you can make. But interest rates are likely to be variable, so they may go up and down in line with the Bank of England’s base rate and your bank’s objectives.

So, while you’ll have more flexibility, you won’t receive the same return on your deposits as you would with a fixed-term savings account.

A tailored approach to protecting your wealth

Consulting with a financial adviser can alleviate your financial worries, so you can make smarter, more informed investment decisions.

Perhaps it’s time to rebalance or diversify your portfolio. Or maybe a high-interest savings account will give you the peace of mind that your money is protected, while giving your finances a boost.

Considering a high-interest rate savings account?

If you’re looking for a way to easily manage and nurture your money, our savings platform can help.

With just one log in, you’ll gain access to hundreds of accounts from several banks, including exclusive interest rates to help your finances grow.

See how Flagstone can help you - use our cash deposit calculator today to get started.