Inflation, employment, and COVID-19: the industry impact

Inflation has been impossible to ignore as people across the globe feel the pinch of soaring food costs, taxes, and energy bills.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

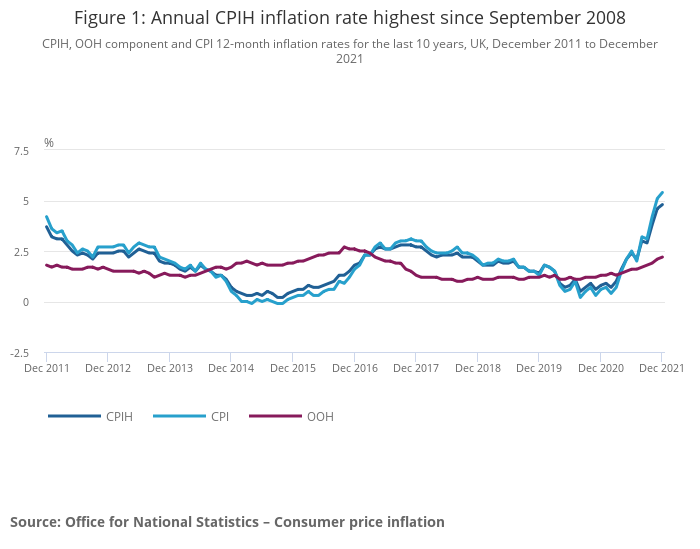

Inflation has been a hot topic of discussion and frankly impossible to ignore as people across the globe feel the pinch of soaring food costs, taxes, and energy bills. According to data released on Wednesday by the Office for National Statistics, prices in the UK have gone up at their fastest rate in nearly 30 years, now sitting at a hefty 5.4%.

With the cost of living currently outstripping expert projections and expected to reach higher levels in the coming months, many economists believe interest rates will increase several times this year.

Adding to the current inflationary pressures is a strong labour market. In a time where the demand for workers exceeds the supply, employers typically need to pay higher wages to attract employees, ultimately leading to rising wage inflation.

However, although the jobs market is booming, wage hikes are being swallowed by the mounting cost of living.

Shane O'Neill, head of interest rate trading for Validus Risk Management, said: “These figures represent another box ticked on the path to more rate hikes, the first of which is expected as early as February.”

When the Omicron wave hit over the festive period, many UK households chose to stay in due to fears of catching the virus, reducing consumer spending. As restrictions are lifted and people gain more confidence in spending their money out, inflation is likely to rise further.

The Bank of England may take the relaxing of restrictions into consideration at its next Monetary Policy Committee meeting when deciding the base rate. In order to encourage saving over spending and control the rate of surging costs, a double in the base rate from 0.25% to 0.5% could well be on the cards next month.

As for movements in the savings market, a number of Flagstone’s bank partners recorded strong inflows into savings accounts over the past month due to the Omicron wave. Although rates remained relatively unchanged across the market last month, our analysis shows interest rates will improve across the board following an increase to the base rate.

But what does this mean for savers? Those that continue to switch to the best savings deals will do better at taming the rate of inflation. Flagstone can take the hassle out of moving your savings around and help your money work harder. Speak to us today to find out more.