Base rate held at 4.25% – what does it mean for your savings?

The Bank of England has held the base rate at 4.25% amid high inflation and global uncertainty. But cuts could be on the horizon. Learn what you can do to protect and grow your cash today.

This article is not advice. If you would like to receive advice on your business' cash reserves, consider speaking to a Financial Adviser.

Bank of England base rate: at a glance

- The base rate remains at 4.25% following today’s Monetary Policy Committee (MPC) meeting.

- UK inflation dipped slightly to 3.4% in May – down from 3.5% in April.

- Global trade tensions are fuelling economic uncertainty.

- Some savings rates still offer strong returns – for now.

- The next Bank of England base rate decision is on 7 August 2025.

The Bank of England has held the base rate at 4.25% as it navigates stubborn inflation and global uncertainty.

The nine-person MPC, which sets the rate, voted six in favour of holding – with three members voting to cut.

Interest rates remain on a gradual downward path.

What influenced the MPC’s decision?

Inflation continues to overshoot target

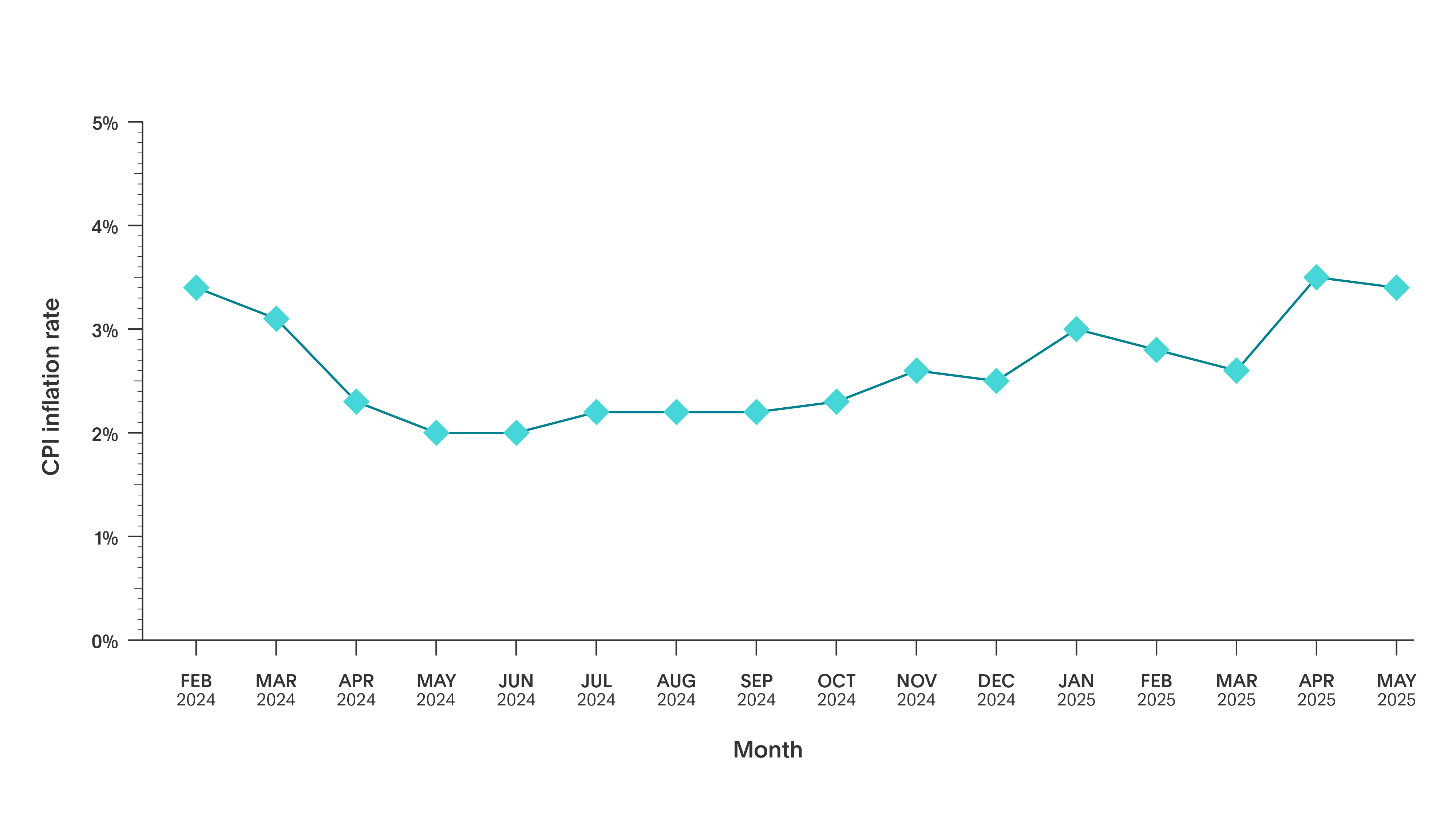

Just a few months ago, inflation looked to be under control. In March, CPI inflation dropped to 2.6%, edging close to the Bank’s 2% target. But by April, it had climbed again – to 3.5%. The latest figures for May show a modest easing to 3.4%.

Food prices in particular have proved hard to shift, rising from 3.4% in April to 4.4% in May. Energy prices have also increased due to the intensifying conflict in the Middle East.

That setback has added to the case for caution. A premature rate cut could risk stalling progress toward the inflation target.

External risks complicate the path ahead

Donald Trump’s tariffs have introduced new risks, but the impact isn’t clear-cut. It’s added another layer of complexity to the MPC’s decision-making.

Governor Andrew Bailey recently described the economic outlook as ‘shrouded in a lot more uncertainty’. A sentiment echoed by a growing number of banks.

Barclays has adjusted its forecast, now expecting the base rate to reach 3.5% in early 2026, rather than by year-end 2025 – one of many recent revisions across financial institutions.

Are interest rates going down?

Holding the base rate at 4.25% could help stabilise interest rates on savings accounts in the short term – particularly for Fixed Term accounts, which tend to lag behind base rate changes.

But that window won’t stay open indefinitely. Some banks have already started lowering Instant Access rates in anticipation of future cuts. That means savers relying on flexibility could see rates drift sooner than those who have locked in their cash.

In this sort of environment, it pays to fix. Putting a significant proportion of your spare cash into one or more Fixed Term accounts is an effective way to shield your money against falling rates.

Time to wake up your cash?

Bank of England data shows that £1.3tn in UK savings is languishing in low-interest accounts – earning less than the rate of inflation. And while today’s decision may feel like a wait-and-see moment, it’s actually an opportunity.

If your cash isn’t reaching its full potential, you still have a chance to lock in competitive rates before the next round of cuts. That’s where Flagstone comes in.

With access to hundreds of savings accounts from over 60 banks, you can compare, switch, and track savings performance. All in one platform, with one password.

Discover how you could protect and grow your cash.

What happens next?

The next base rate decision will be announced on Thursday 7 August 2025, followed by reviews in September, November, and December.

Each meeting concludes at 12.00pm, with an update on the base rate and the Bank’s economic outlook.

Frequently asked questions about the Bank of England base rate

What is the Bank of England base rate today?

As of 19 June 2025, the base rate is 4.25%.

Will the base rate go down in 2025?

Financial markets are pricing in one more cut in 2025. But that depends on inflation falling and global economic stability returning.

How does the base rate affect savings accounts?

Interest rates on savings accounts often move in line with the base rate. When the Bank of England changes the base rate, financial providers typically adjust the interest rates on Instant Access accounts first, followed by Fixed Term accounts.