Trusted by the UK’s leading wealth managers

Maximise their interest

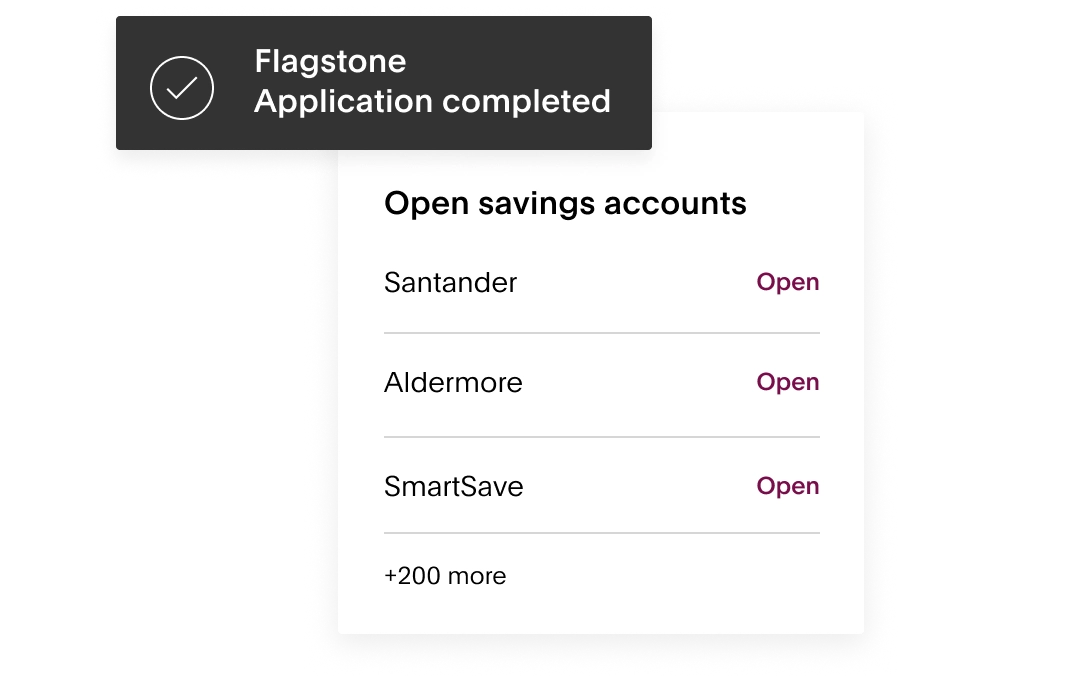

Your clients can open hundreds of accounts from 60+ UK banks, including exclusive rates. This is where cash goes to grow.

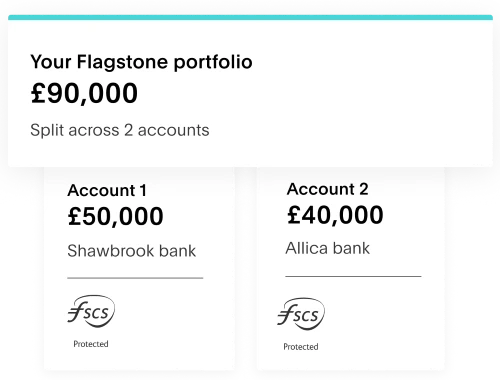

Protect what’s theirs

Your clients can split their cash between banks, for maximum FSCS protection on their eligible deposits up to £85,000 per banking group. Like a suit of armour for their savings.

Escape the paperwork

Your clients can access hundreds of rates with one application, and manage their savings with one password. Arrivederci, admin.

FSCS protection and interest rates illustration

Use our cash deposit calculator to see how much interest your clients could be

earning, whilst spreading their deposits to maximise FSCS protection.

We've already deducted our share of interest from the rates in the calculator.

All UK-based banks and building societies on our platform are members of the Financial Services Compensation Scheme.

The scheme will protect your up to £85,000 per UK banking group (£170,000 for joint accounts).

Please get in touch with us if you’re looking to open a joint account, or if you have specific requirements.

Three reasons to refer your clients

One relationship

None of our bank partners will ever contact your clients. The only voice that matters is yours.

One platform

Refer, manage, and support your clients. All from your very own referral portal.

One clear view

Track your clients' cash in one place, monitor maturities, and plan for the future.

How to refer your clients

Using the referral portal is simple, quick, and paperless.

Your clients can start saving with just £50,000

Our minimum deposit is £50,000. There is no maximum deposit – and no limit on your clients' returns.

The numbers that count

£15 billion

in assets under administration

5,400+

advisers who have chosen to work with us

600,000+

Flagstone clients

What our adviser partners say

Savile Row financial services

By offering a huge range of cash savings accounts that are accessible almost instantly, Flagstone betters client outcomes.’

Castell Wealth Management

'With Flagstone, our clients can open and manage various accounts in one place, saving time and hassle. The platform allows for total flexibility.'

Riverfall Financial

'Cash remains a safe place for a lot of people. And, with Flagstone's offering, we feel we have a great solution that perfectly complements our overall service.'

How Flagstone

makes money

For each savings account your clients open through Flagstone, we receive a small share of the interest. We deduct that share before we feature any savings account on our platform. So the rate your client sees is always the rate they'll receive.

You can choose to earn a 15% share of your clients' interest – or you can waive this entirely. The choice is yours.

How our share of the interest works for individual, joint, and business accounts→

Talk is cheap. Trust is earned.

We work with more banks than any other cash deposit platform. The choice is yours.

Our partner banks

You can browse and choose competitive and

exclusive interest rates from up to 60+ banks. Bank

access is dependent on your client profile.

Partner with Flagstone.

We're here to help everyone manage, protect, and grow their cash – and our partners are a vital part of that push. How might our market-leading platform support you and your business?

We’re at your service.

Still need answers? Whether you’re already a referrer or you’re just getting started, we’re here to help.

Call us on +44 (0)203 745 8130, Monday-Friday 9am-5.30pm.