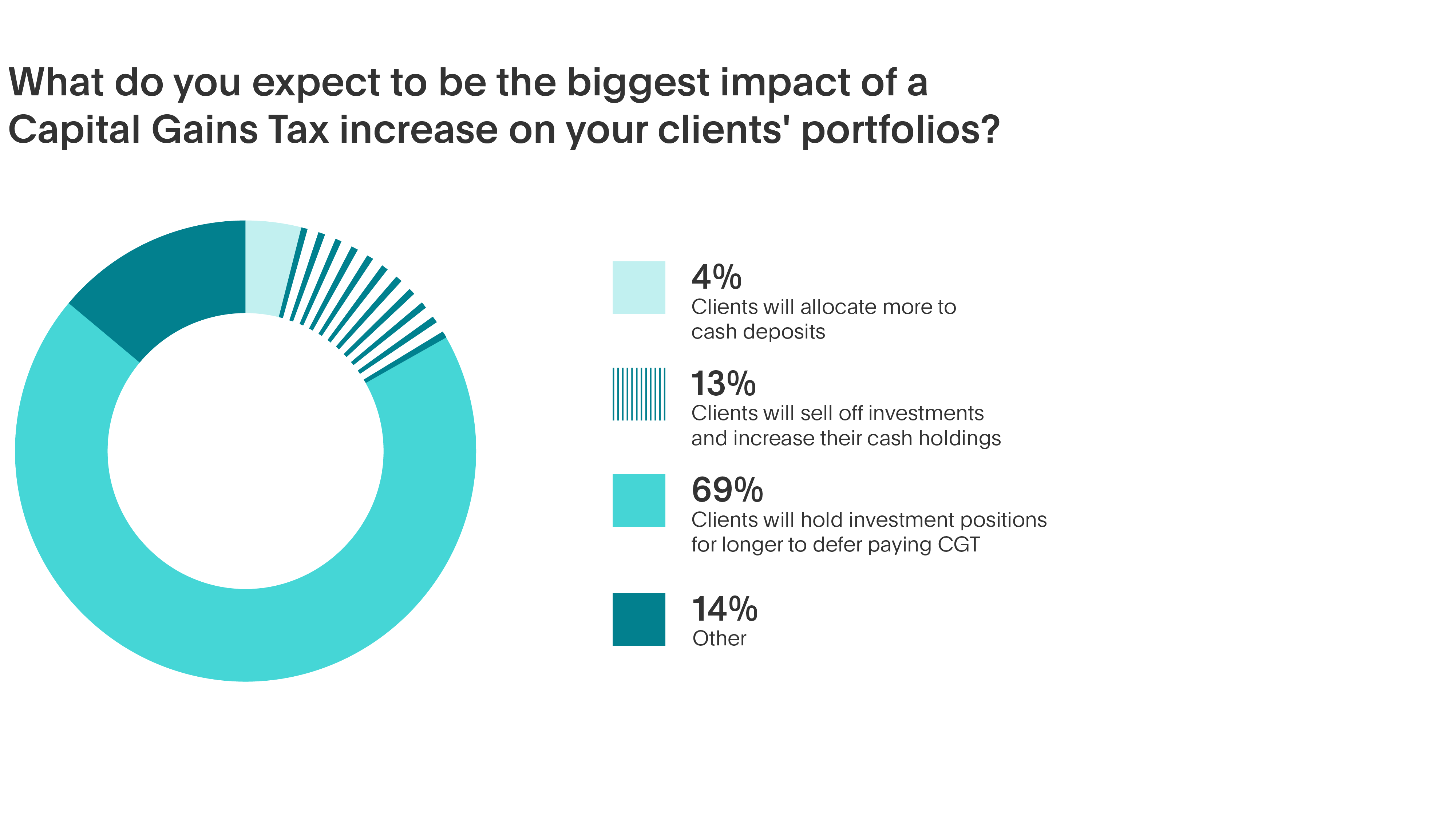

Almost seven in ten (69%) UK IFAs believe most clients will hold investments longer now to defer paying higher CGT, according to the latest Flagstone Base Rate Poll*. 17% of respondents say that clients will allocate more to cash or sell off investments and switch to cash.

This follows a late-October poll of Flagstone customers** which found that more than a third (34%) of Flagstone savers expect to invest less now or in the future as a result of the CGT change.

Simon Merchant, CEO of Flagstone, comments:

“A CGT increase had been signposted for many months. But it will have taken many investors – and their advisers – by surprise that the Treasury decided against delaying the hike until the new tax year. Investors must now choose which investments to keep and which to divest, to minimise the impact of higher CGT liability further down the line.

“Most advisers expect clients to hang tight. But, if the signals are correct, while holding stocks longer defers CGT liability, this will only delay the returns.

“Investors exiting investments would be wise to consider the competitive risk-adjusted returns they can enjoy from savings while rates remain high. Clients for whom investing has lost its appeal may be heartened to see the dozens of Fixed Term rates still available that exceed inflation by as much as 2.5 - 3%.”

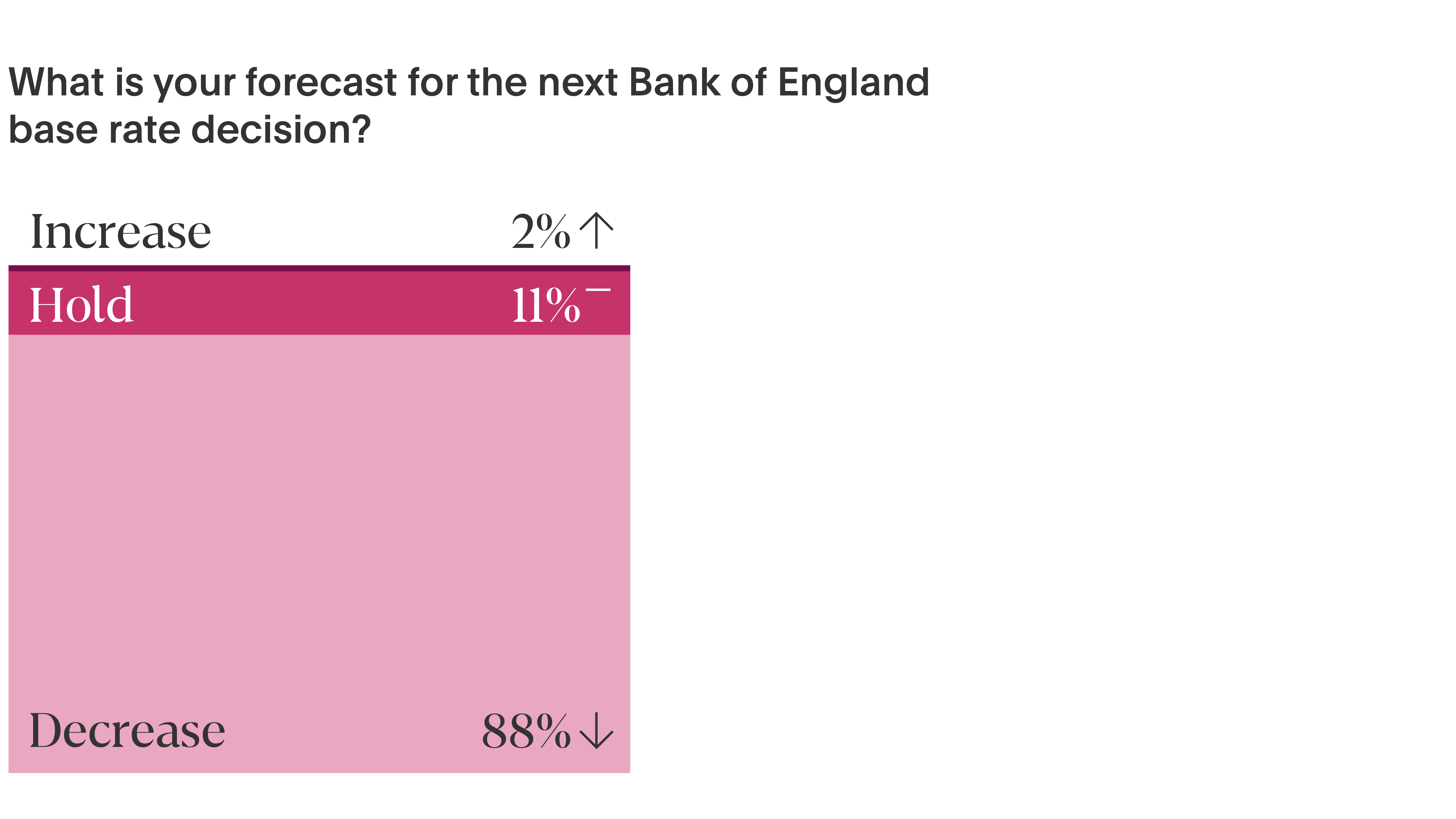

Flagstone’s poll also finds that almost 9 in 10 (88%) UK IFAs are predicting a base rate cut when the MPC meets on Thursday 7 November. Ahead of the last base rate vote in September, the majority of respondents correctly predicted a hold.

Merchant concludes: “Rates for more than 200 savings accounts dipped by 0.2 to 1% in the first week after the July base rate cut.*** Rates will almost certainly fall in November, and then again if a third cut comes in December. In a falling rate environment, diversifying your savings by term length is a good choice – and using a savings platform is a particularly efficient way to ensure maximum diversification. It provides reliable liquidity without impinging on your capacity to capitalise on the relentless competition among banks to stay at the top of the best-buy tables.”

* Flagstone Base Rate Poll methodology: industry research canvassing opinions of 93 UK financial advisers and wealth managers, 21-27 October 2024

** Flagstone Customer Poll, October 2024

*** Money.co.uk, August 2024

Press office contacts

Carmen Dixon: 07717 278846 | carmen@ripplecomms.co

Jo Candy: 07909 992082 | jo@ripplecomms.co