Current accounts vs. savings accounts: at a glance

- What do I need to know? Current accounts and savings accounts are useful for different reasons, which is why a mix of both can be helpful.

- What does it mean for me? Different account types let you strike the perfect balance between long-term savings and short-term spending.

- Why does it matter? Getting your savings strategy right gives you peace of mind that you’re earning as much as possible.

Easy access to cash is important, but there’s a chance you could limit your earning potential without knowing it.

Savings accounts offer higher interest, provided you can be flexible with when you withdraw your cash. So, how can you balance your finances between the best returns and peace of mind?

In this guide, you’ll learn how to compare savings and current accounts, so you can structure your cash to earn the interest you deserve.

What is a savings account?

Savings accounts offer high interest rates on your deposits. They are designed to grow your wealth in the medium-to-long term, depending on the account type:

- Fixed-rate accounts: usually offer higher interest rates in exchange for locking your cash away for an agreed period.

- Instant-access accounts: provide immediate access to your money, often at a lower interest rate.

- Notice accounts: combine the benefits of both, giving you access to your money within a timeframe agreed upfront.

What is a current account?

Current accounts are used for daily transactions and direct debits, like paying for groceries or house bills.

You can access your money instantly with a current account, but you earn low-to-no interest on your balance.

Comparing the differences between current and savings accounts

Let’s take a look at the characteristics of current accounts, and how they compare to savings alternatives:

| Characteristics | Current account | Savings account |

| Purpose |

Daily transactions and recurring expenses. |

Grow wealth with high interest rates. |

| Fees |

Possible account fees, overdraft charges, or penalties for not meeting minimum deposits. |

Can include early withdrawal penalties or charges for not meeting minimum deposits. |

| Interest |

Interest is usually lower than inflation, eroding your purchasing power over time. |

High interest rates can outpace inflation. Compound interest can grow your wealth faster the longer you save. |

| Access |

Easy, instant access to your funds. |

Can offer instant access, unless you open a fixed-rate account or agree to a notice period for even higher interest rates. |

| Tax implications |

You don’t pay tax on your current account balance. |

The interest you’re paid is generally taxable, unless you earn it on ISA deposits. The annual Personal Savings Allowance (PSA) doesn't apply to higher earners. |

Advantages and disadvantages: how do accounts compare?

Now we’ve explored how each account type works, let’s look at their potential advantages and disadvantages.

| Current account | Savings account | |

| Advantages |

|

|

| Disadvantages |

|

|

How much money should I keep in each account?

It’s generally a good idea to keep enough cash in your current account to cover your daily expenses, with a buffer for unexpected or emergency costs. But as we’ve seen, money in current accounts earns little if any interest. Your leftover cash could earn more in a savings account.

A common money management strategy is the ‘50/30/20 rule’. The rule suggests putting 50% of your income towards essential costs, 30% to wants, and 20% to savings. But if you’re a higher earner, you may gain even more from putting a greater share of your income aside.

This is because there are tax-efficient ways to build your future wealth, such as increasing pension contributions.

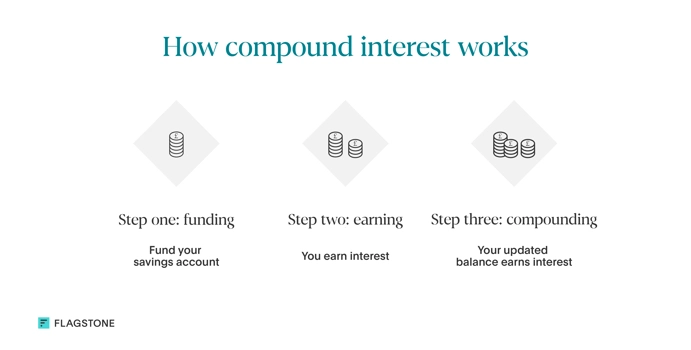

Compound interest can grow wealth faster

For those looking to build generational wealth, it can pay to consider compound interest. The longer you leave your funds, the more interest they accumulate.

A high interest rate can outpace inflation, ensuring your cash doesn’t lose value long term. Savings accounts - especially those with fixed rates - can offer a secure way to grow your wealth with lower risk than stocks or other investments.

The limits of FSCS protection

It’s also important to remember the FSCS (Financial Services Compensation Scheme) only protects up to £120,000 per person, per financial institution.

For savers with significant deposits, spreading your cash across multiple accounts protects you if the worst happens.

Frequently asked questions about current and savings accounts

Which is better, a savings account or a current account?

You can use current accounts and savings accounts for different purposes. And you’ll need both to manage your everyday spending and grow your wealth over time.

Savings platforms let you compare and combine the latest savings account rates to make sure you’re earning as much as possible on your money.

Can you use a savings account as a current account?

While some savings accounts offer instant access to your cash, they aren’t a substitute for current accounts for a handful of reasons.

You generally cannot use a savings account to make direct debits or scheduled payments. And they typically don’t come with payment cards or chequebooks.

Savings accounts are designed to grow your wealth by compounding the interest you earn. And the more you spend, the more you reduce your earnings.

Can I have a savings account without a current account?

Many banks or providers will allow you to open a savings account even if you don’t hold a current account with them. But current accounts are still useful.

Accessing exclusive interest rates through savings platforms like Flagstone requires a quick identity verification. This may include checks on your current account.

Should I use both savings and current accounts?

Current and savings accounts provide different advantages when it comes to managing your money.

Splitting your money between both types of accounts gives you instant access to cash while letting you earn interest through your savings. Maximising the interest you earn is particularly important for higher earners, as you receive less tax relief on your savings.

Efficient spending and saving

Current and savings accounts can provide immediate access to your cash, while helping you grow your wealth for the future.

While your current account lets you access your cash whenever you need it, your savings can outpace inflation in high-interest accounts.

Grow your savings in high-interest accounts with Flagstone

Access hundreds of high-interest accounts from more than 60 banks with Flagstone. All with one login, with one password.

See how much interest you could be earning on your savings.