Savings and pensions: at a glance

- What do I need to know? You can protect and grow your long-term wealth with a balance between savings and pensions.

- What does it mean for me? Choosing how to allocate your contributions is important in achieving your financial goals.

- Why does it matter? Setting personalised retirement savings targets can help to determine the best approach for your finance goals.

Contributing to savings and pensions helps grow your wealth for the long term. But how should you split what you have between the two to maximise your earnings?

In this guide, you’ll learn about savings and pensions, how you can access your money, and the tax advantages you can enjoy.

What are the different types of pensions?

Pensions provide a secure way to grow your savings for retirement. You can contribute monthly, or in lump sum instalments. You can also earn interest on your contributions, and the money you save is usually invested by your pension provider to grow its value over time.

There are two main types of pensions:

- State Pension: In the UK, the State Pension provides the foundation for your retirement income. The government pays income monthly to taxpayers who have contributed to National Insurance (NI) during their working years.

- Personal pension: A personal pension is a tax-efficient savings plan designed to help you build a retirement fund. These types of pensions include defined contribution pensions, self-invested personal pensions (SIPP), and workplace pension schemes. In most cases, employers are legally required to contribute to workplace pensions, and you can increase your own contributions to maximise tax efficiency and grow your retirement fund.

What are the different types of savings accounts?

Savings accounts offer greater flexibility than pensions, as you don’t have to wait until retirement for access. Although, you can still use them to save for your retirement if you wish.

The main types of savings account include:

- Instant Access savings accounts: These give you the flexibility to withdraw your money at any time without penalties. This means they typically offer lower interest rates than notice or fixed-term alternatives.

- Notice savings accounts: You’re required to notify your provider before withdrawing funds. The interest rate is often higher than instant access accounts.

- Fixed Term savings accounts: These accounts offer a high guaranteed interest rate in exchange for locking your cash away for a set period. You cannot withdraw your funds before the end of the term without paying a penalty.

- Individual Savings Accounts (ISAs): Your cash is shielded from tax. This means you can earn interest tax-free. You can only save a maximum of £20,000 per year in an ISA. Some types of ISAs limit contributions further (LISAs, JISAs).

Is it better to pay into a pension or savings account?

Now we’ve looked at the differences between pensions and savings accounts, we can compare the key features of each. Below, we explore in detail how each can contribute to a balanced portfolio:

| Characteristics | Savings | Pensions |

| Access and flexibility | Depending on the account type, your money may be accessible instantly or on a set date. Generally, the longer you lock away your cash, the higher the returns. | You cannot access a personal pension until you turn 55 (increasing to 57 in 2028). The State Pension is inaccessible until you turn 66 (rising to 67 by 2028). |

| Interest | Interest rates vary by savings account - often increasing the longer you lock your cash away. Fixed-rate accounts mean you know exactly how much you'll earn on your cash. Your money usually earns compound interest. | Pensions also grow through compound interest. You can often choose your level of risk, potentially increasing returns. But as with all investing, you can lose your money, as there are no guarantees, unlike fixed-rate savings. |

| Tax | Interest earned on savings is generally taxable for higher earners, beyond the annual ISA allowance. The annual Personal Savings Allowance (PSA) doesn't apply to higher earners. | Pension contributions receive tax relief, reducing your taxable income. Your money is only taxed at withdrawal, as it determines your Income Tax band. You can also take 25% of your total pension pot as a tax-free lump sum. |

| Limits | Contribution limits vary by account type and provider. Many savings accounts have no maximum contribution limit, while some require a minimum deposit. | You can save a maximum of £60,000 a year tax-free into your pension under the annual allowance. If your income exceeds £260,000, including salary sacrifice, the tax-free amount tapers downwards. The minimum reduced annual allowance you can have in the current tax year is £10,000. |

| Withdrawals | The rules of the account determine your withdrawals. Unless your account states otherwise, you can withdraw all or part of your savings. | Pensions can be paid either as an annuity, or as a drawdown. A drawdown allows you to access your pension funds more flexibly. You're also entitled to withdraw a 25% lump sum from your pension tax free. |

| Long-term growth | Spreading money between multiple accounts can allow you to take advantage of higher interest, without limiting access to your money. | Pensions support long-term growth through tax-free contributions, investment earnings, and compounding. The earlier you start, the more your funds can grow. |

Pensions and savings both allow you to invest in your future. Achieving a balance between the two lets you enjoy the advantages of each. You can use savings accounts to fund part of your retirement, but this can be less efficient than depositing directly into your pension.

Which is better for retirement funds?

Pensions are the most tax-efficient way to save for your retirement. Contributions can be made tax-free, and any growth on your fund is only taxable when you withdraw. Once you’re eligible, you can also take a 25% tax-free lump sum of your total fund (as long as this is within the lifetime Lump Sum Allowance of £268,275).

Pensions are a much longer-term strategy than savings accounts. Your deposits are invested in stocks and bonds, with the goal of increasing the value of your funds to outpace inflation.

Why pensions are tax efficient

If you don’t take full advantage of the tax benefits that come with a pension, you’ll end up paying more in tax now. This is because your rate of Income Tax is likely higher during the peak earning years of your career.

Once you’ve retired, presuming you’ve paid off your mortgage, other debts, and your children have left home, your expenses are likely to decrease. This means you can withdraw less of your pension every year, thereby lowering your income on the money you’ve saved.

A smaller income means a lower Income Tax bracket, letting you keep more of what you’ve earned.

Why savings are also essential to futureproof finances

Pension providers invest your funds to grow their value. Although pensions are usually invested in very low risk assets, there’s no such thing as a risk-free investment. By building substantial savings outside of pension contributions, you’re less exposed to unexpected losses.

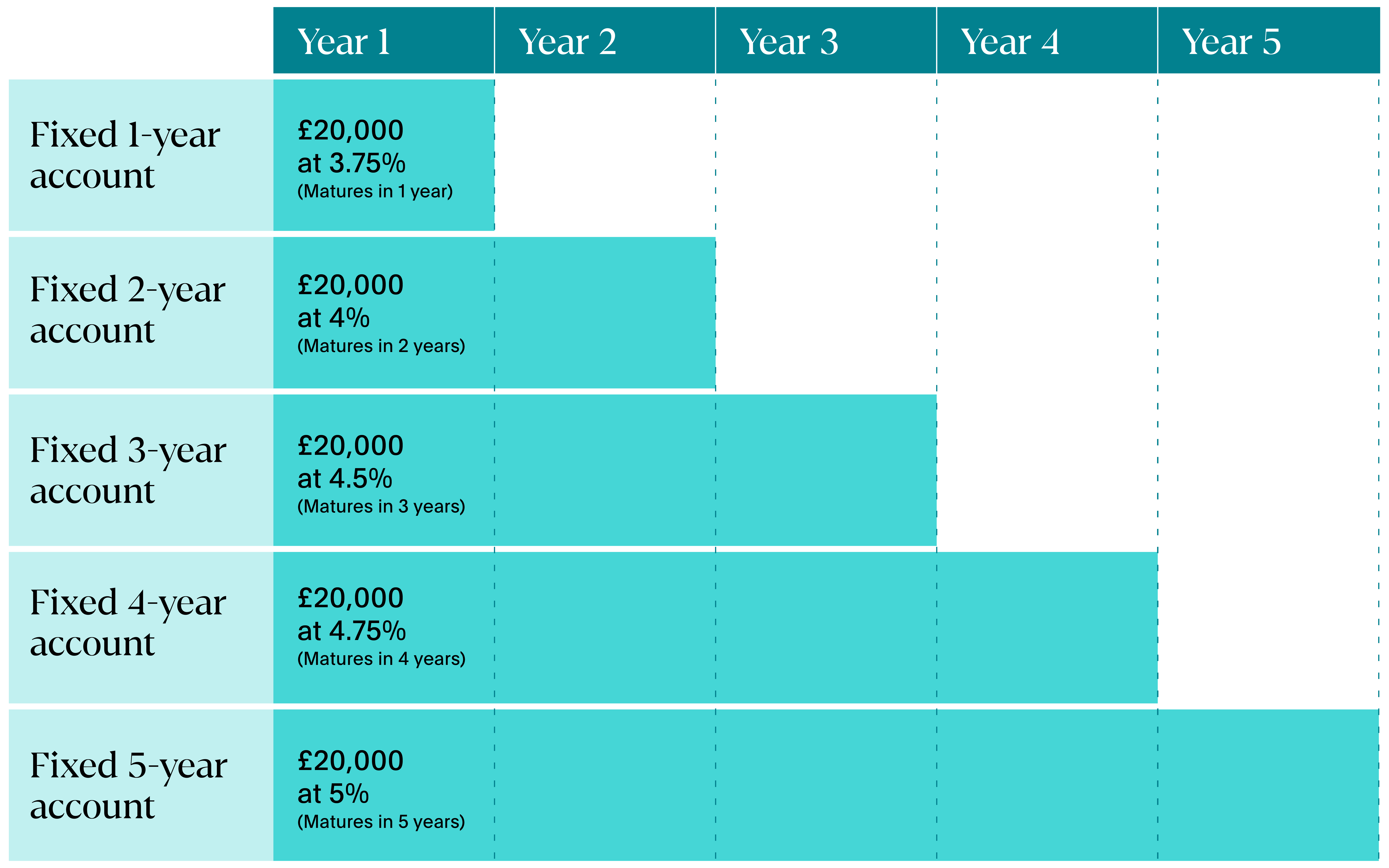

Savings accounts also provide flexibility to access your cash outside of monthly annuities. And structuring your cash using the laddering technique can grow your wealth faster than the rate of inflation without locking all your money away.

Frequently asked questions about the benefits of savings and pensions

What’s the 70% rule for pensions?

The ‘70% rule’ determines how much of your income you should save for retirement. The rule suggests that you’ll need around 70% of your pre-retirement salary per year in your pension to sustain your current lifestyle.

The rule assumes the lack of work-related expenses, saving for the future, and the increase of your wealth over the course of your career will lower your living costs.

Can I put a pension into a savings account?

You can put some of your pension into a savings account if you have a Self-Invested Personal Pension (SIPP). This type of personal pension gives you greater control over how you invest your funds. You can choose to do this yourself or seek advice from financial experts.

Pensions are designed to get the most out of your deposits long term. And putting this money into a savings account doesn’t guarantee a better return. Instead, finding a balance between your pension and savings strategies gives you the benefits of both.

How much should I have in my pension at 50 in the UK?

A common rule of thumb is that you should have around five to six times your annual salary in your pension by the time you reach 50 years old.

This roughly aligns with the 50-70% of your current annual salary.

Your 50s are also a good time to review your saving priorities. With retirement on the horizon, you’ll need to assess the value of your pension pots and whether you’re on track to achieve a comfortable lifestyle.

Are pensions really worth it?

Pensions offer benefits that other savings can’t – especially in relation to tax. It is worth remembering that your pension is invested by your provider. While investments can always lose money, the focus on long-term growth helps reduce short-term risk.

Pensions can represent a valuable part of your long-term financial plan, even if you use other savings to increase your quality of life in retirement. If you’re unsure about the right balance between savings or pensions for you, speak with a financial advisor.

Build a balanced portfolio to enjoy your later life

Saving your wealth in pensions and high-interest accounts gives you to the best chance of enjoying your retirement.

A balanced approach offers you the best of both worlds, combining tax relief and flexibility for the highest returns in your golden years.

Access high-interest rates with Flagstone

Flagstone's savings platform gives you access to hundreds of high-interest accounts from 60+ banks.

All in one platform, with one password.