Multiple savings accounts: at a glance

- What do I need to know? You’re not limited to a single savings account in the UK.

- What does it mean for me? You could miss out on earning high interest on cash deposits by limiting yourself to one account.

- Why does it matter? Your money can often outpace inflation if you use savings platforms that make it easy to manage your cash.

If growing and protecting your money is important to you, then adding a second, third, or fourth savings account to your portfolio is a good idea. This is especially true if you’re strategic in selecting multiple savings accounts with a high level of interest, and different maturity deadlines.

By contrast, if you’re someone whose loyalties lie with one bank, chances are you’re missing out on several benefits that can strengthen the earning potential of your cash.

How many savings accounts can you have?

Contrary to popular belief, there is no limit to how many savings accounts one person can open. Although many people believe one is enough, opening multiple savings accounts has several benefits that can strengthen your finances.

Here are four reasons why it’s a good idea to open multiple savings accounts:

Four benefits of opening multiple savings accounts

1. Grow your savings faster

A smart savings hack is to open several fixed-term accounts of different lengths. This way you will benefit from long-term rates while always having some money available as accounts mature at chosen regular intervals.

As rates change, money can be moved accordingly to get the best returns on the highest balance. This approach is called laddering.

Explore: growing and safeguarding your savings

Laddering: a technique to build your cash savings

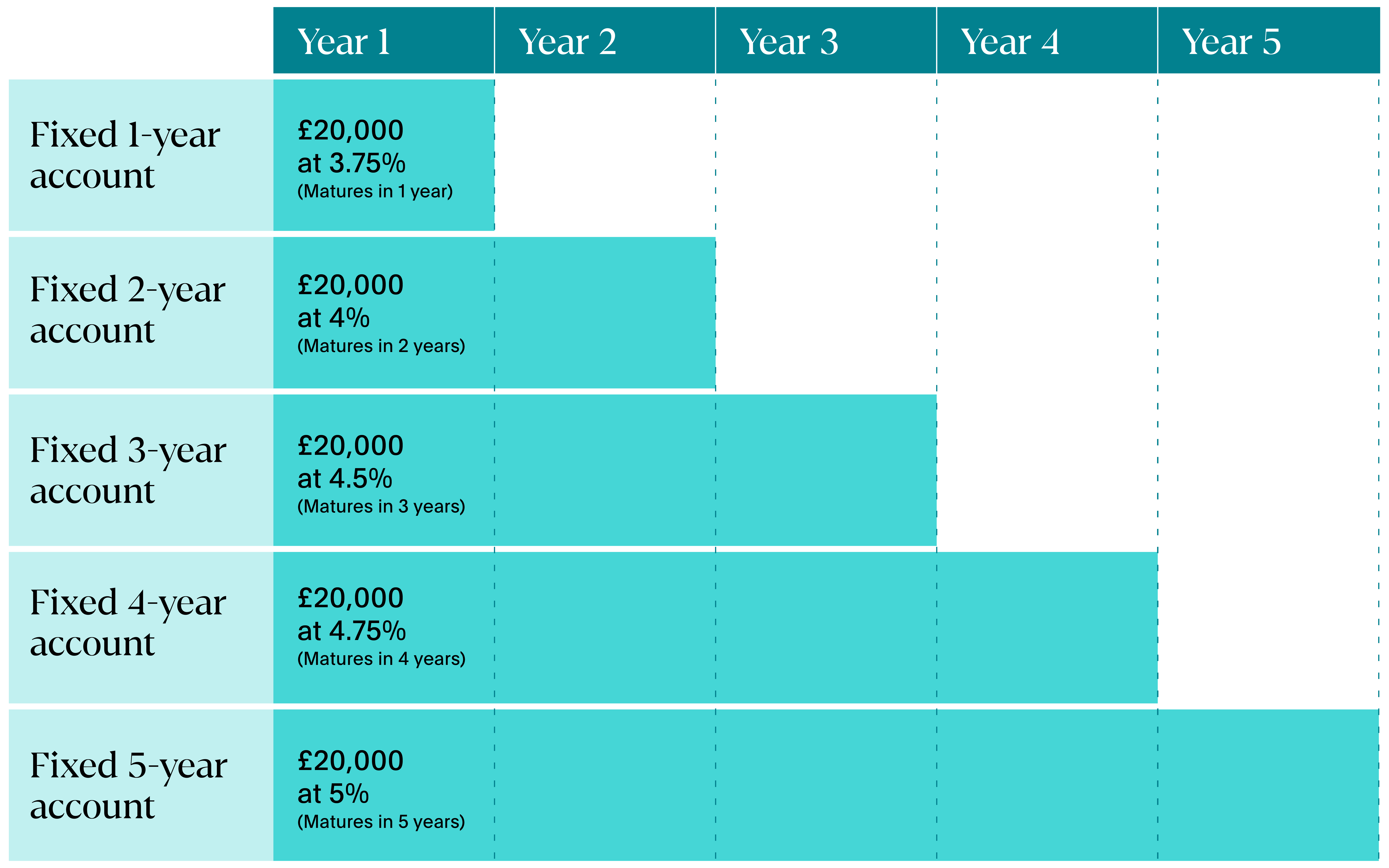

Let’s say you have lump sum of £100,000 in cash. Start by dividing it into portions or ‘ladder rungs’, to deposit into savings accounts with different maturity periods and interest rates. You might choose to divide it into five equal amounts of £20,000.

Look for accounts with terms ranging from short to long and opt for accounts with higher interest rates as the time period increases. You can now spread the money across these accounts. For example, you could put £20,000 in a one-year savings account, another £20,000 in a two-year account, and continue this pattern for three, four, and five years.

As each account matures, reinvest the funds into a new account with a longer term and better interest rate, gradually building a ladder that maximises returns while ensuring liquidity.

Explore Flagstone’s latest interest rates

2. Track the progress of your goals

Having different accounts for individual savings goals (such as a house deposit or emergency fund) allows you to see how much you have set aside for each. It makes it easier to monitor spending patterns and encourages healthy saving habits.

3. Protect your wealth

Since the collapse of Northern Rock bank, the safety net for savings has been considerably improved. But savers still face risks. Any savings over £85,000 in an individual account and £170,000 in a joint account is at risk of loss if the bank was to fail.

Spreading and diversifying cash between a number of banks can give you FSCS protection, keeping your money safe and insured. The FSCS covers multiple accounts as long as they are with different banking institutions and the amount in each account is under the limit.

4. Minimise the chance of misspending

Creating clarity around how much is saved for each goal also highlights how much is available to spend, reducing the temptation to dip into funds and preventing overspending. Withdrawal restrictions on certain savings accounts will also stop you from exhausting your cash.

Frequently asked questions on opening multiple savings accounts

1. Is there a penalty for having multiple savings accounts?

No. Opening multiple savings accounts shouldn’t incur any penalties, provided the financial institutions in question conduct a ‘soft’ credit check . If you join Flagstone, you only need to apply once to access 60+ banks, opening as many accounts as you need to maximise your cash.

2. Are you allowed to have two savings accounts?

Yes, and many more. There isn’t a limit to the number of bank accounts you can open. Although many people choose to leave their cash in one bank, you can potentially increase your earnings by spreading your deposits across financial institutions, provided they’re protected by the FSCS.

3. Can you have three savings accounts with the same bank?

Yes, although the benefits of this strategy are debatable. Should your financial institution go bankrupt, you would only be protected up to a maximum of £85,000 under the FSCS, per person, per institution. If you have deposits with several banks and financial institutions, you can spread your risk should the unexpected occur.

How do you manage multiple accounts?

Opening and managing several accounts might seem like arduous work and admin – but it doesn’t need to be that way. Cash deposit platforms, otherwise known as savings marketplaces or platforms, are making it easy for consumers to open and move money between multiple accounts.

Open multiple savings accounts to protect earnings

Flagstone’s savings platform offers access to a wide range of accounts with varying banks and terms. With just one log in, it eliminates the hassle of application forms and allows you to move money around with ease.

This new way of saving is helping people grow and protect their wealth so they can plan for the future.

Explore your earning potential with Flagstone

Use our savings calculator to spread your cash across accounts at high interest, whilst maximising FSCS protection.