Everything you need to know about fixed rate savings accounts

If you’re able to lock away your money for longer, you’ll usually benefit from a higher ‘fixed’ interest rate. Discover how fixed rate accounts work, their pros and cons, and how to use them to your advantage.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

Last updated: 02 May 2025

Choosing the right account for your savings can help your cash reach its full potential and bring your goals within closer reach – whether you’re saving for your dream wedding, a down payment on a house, or your retirement nest egg.

In this article, you’ll learn what a fixed rate account is, how they work, their pros and cons – and how to use them to your advantage.

What is a fixed rate savings account?

A fixed rate savings account offers a guaranteed interest rate in exchange for locking your money away for a set period. They can also be known as a fixed term account, fixed rate deposit, or fixed rate bond.

Generally, the longer you’re willing to commit, the higher the rate you can earn. Most terms range from one to five years, though some accounts run as short as one month or as long as ten years.

How do fixed rate savings accounts work?

A fixed rate savings account involves locking your money away for a set period – known as the ‘term’ – in exchange for a guaranteed interest rate. That means you’ll know exactly how much your savings will grow from day one.

Most accounts require a lump sum deposit when you open the account, and interest is usually paid either monthly or annually, depending on the provider.

Once your money is added to your account, you won’t be able to access it until the end of the term. Early withdrawals can result in penalties – often meaning you’ll lose some or all of the interest you've earned.

Just like other savings accounts, cash in fixed rate accounts is covered by the Financial Services Compensation Scheme (FSCS) – protecting up to £85,000 per person, per bank.

What are the pros and cons of a fixed rate account?

| Pros | Cons |

| Higher returns: fixed rate accounts usually offer better interest rates than instant access or notice accounts – helping your savings grow faster. | No early access: your money is locked away for the full term. Accessing it early often means losing interest or paying a penalty. |

| Rate certainty: your interest rate is locked in for the full term, shielding you from future rate cuts and giving you a clear picture of your returns. | No top-ups: once you’ve opened the account, you usually can’t add more money to it. |

| Less impulse spending: if you're tempted to dip into your savings, a fixed rate can help you stay on track by removing that option. | No flexibility if rates rise: if the base rate increases, your rate won’t change – unlike with instant access accounts that track market rates. |

| Predictable income: many accounts pay interest annually or monthly, with the option to have it paid into your account – so you can track your growth. | Minimum deposit requirements: most fixed rate accounts require a lump sum to get started, which may not suit everyone. |

Frequently asked questions about fixed rate savings accounts

Can you add money to a fixed rate savings account?

Not usually – most fixed rate accounts only accept a single deposit when you open the account. You may not be able to top it up once the term has started.

How many fixed rate savings accounts can I have?

There’s no limit. You can open multiple accounts, taking advantage of varied interest rates, and choosing different maturity dates – so you always have access to some money. Spreading cash between a number of banks can also give you FSCS protection.

Who are fixed rate savings accounts for?

They’re ideal for people who can set money aside without needing to access it in the short term – and who want a guaranteed return without the risk of interest rate changes.

Can my financial provider change the interest rate?

No. The rate is fixed from the moment you open the account, and it won’t change until the end of the term – also known as the maturity date.

What do 'term' and 'maturity' mean?

The term is how long your money stays in the account. Maturity is the end of that period – when your account closes.

Use fixed rate savings accounts to grow your lump sum

Fixed rate accounts are popular with people who want to grow their cash and can put a sum of money aside without the need to access it in the short term.

For example, you may have received money from an inheritance, or a house or business sale. Or you may be beginning to think about retirement and would like an extra cash boost to complement your pension, while enjoying added security.

Fixed rate accounts are also ideal if you’re more risk-averse and want to guarantee your returns, rather than being at the sharp end of rapidly changing financial markets.

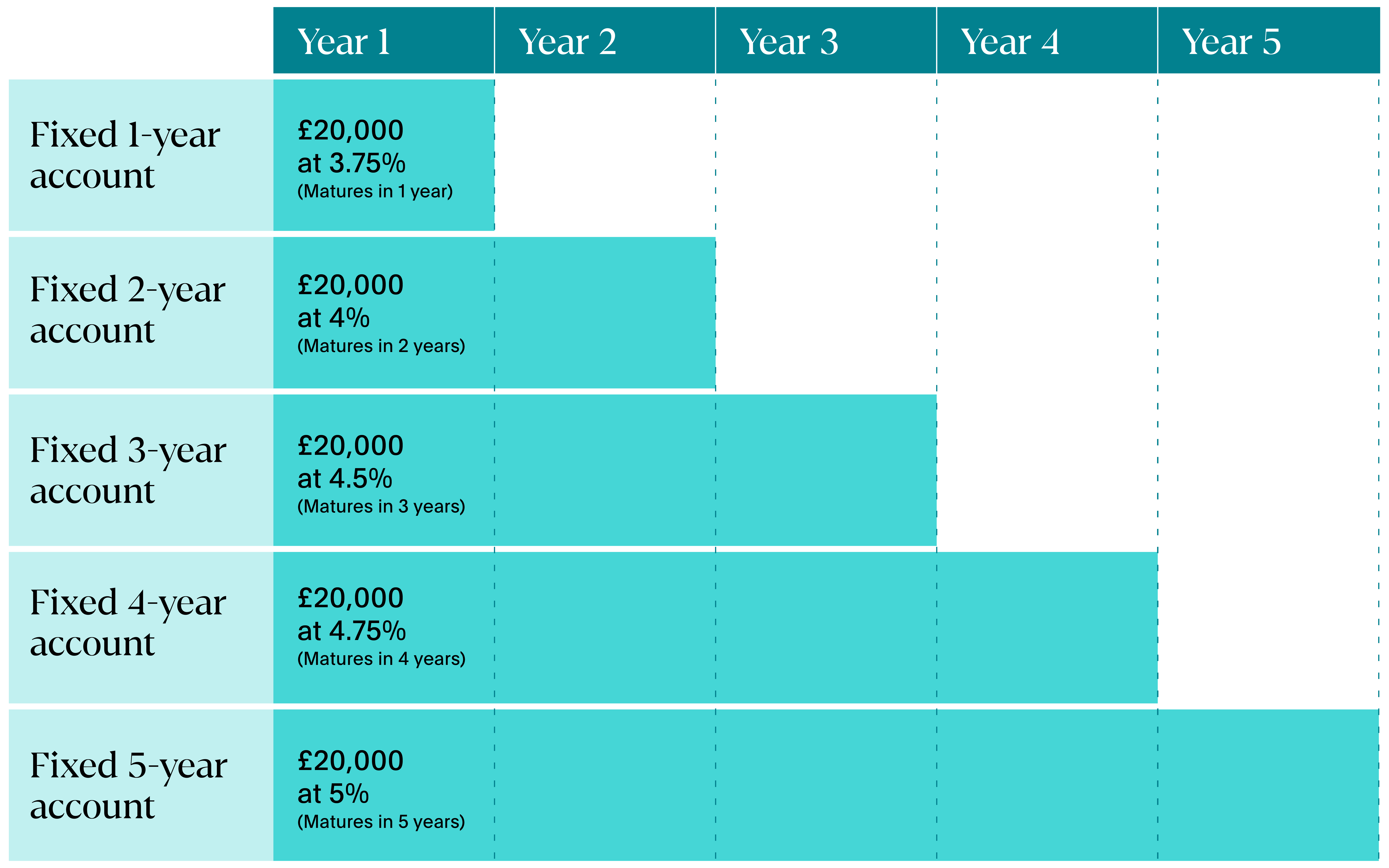

When the term ends, you can reinvest your money into a new fixed rate account. Or you can use a laddering approach – spreading your savings across multiple terms that mature at different times. That way, you keep earning interest while maintaining access to some of your cash. Here's an example of how laddering works:

Find the right account – without the admin

Searching for competitive interest rates can be time-consuming. But Flagstone makes it simple.

With access to hundreds of savings accounts from 60+ banks, you can compare, choose, and open multiple accounts in just a few clicks. All in one place, with one login.

Ready to see how much interest your money could earn?