Compound interest explained: understanding the benefits of early saving

Understanding compound interest can transform your savings and give you a greater return on your deposits. We’ve put together this beginner’s guide, explaining what compound interest is and how it works.

This article is not advice. If you would like to receive advice on your savings and investments, consider speaking to a Financial Adviser.

Funding an account is essential to build up your savings, but it doesn’t have to stop there. If you open an account with a high AER (Annual Equivalent Rate), your deposits can grow faster than you might expect, thanks to compound interest.

In this beginner’s guide, we’ll explain compound interest, covering how it passively builds your savings and wealth over time.

What is interest?

Your savings earn money, which is paid to you by the bank that holds your account. This is called interest. The longer you leave your savings, the more you earn.

There are two kinds of interest you can earn on deposits. They are simple and compound interest.

What is compound interest?

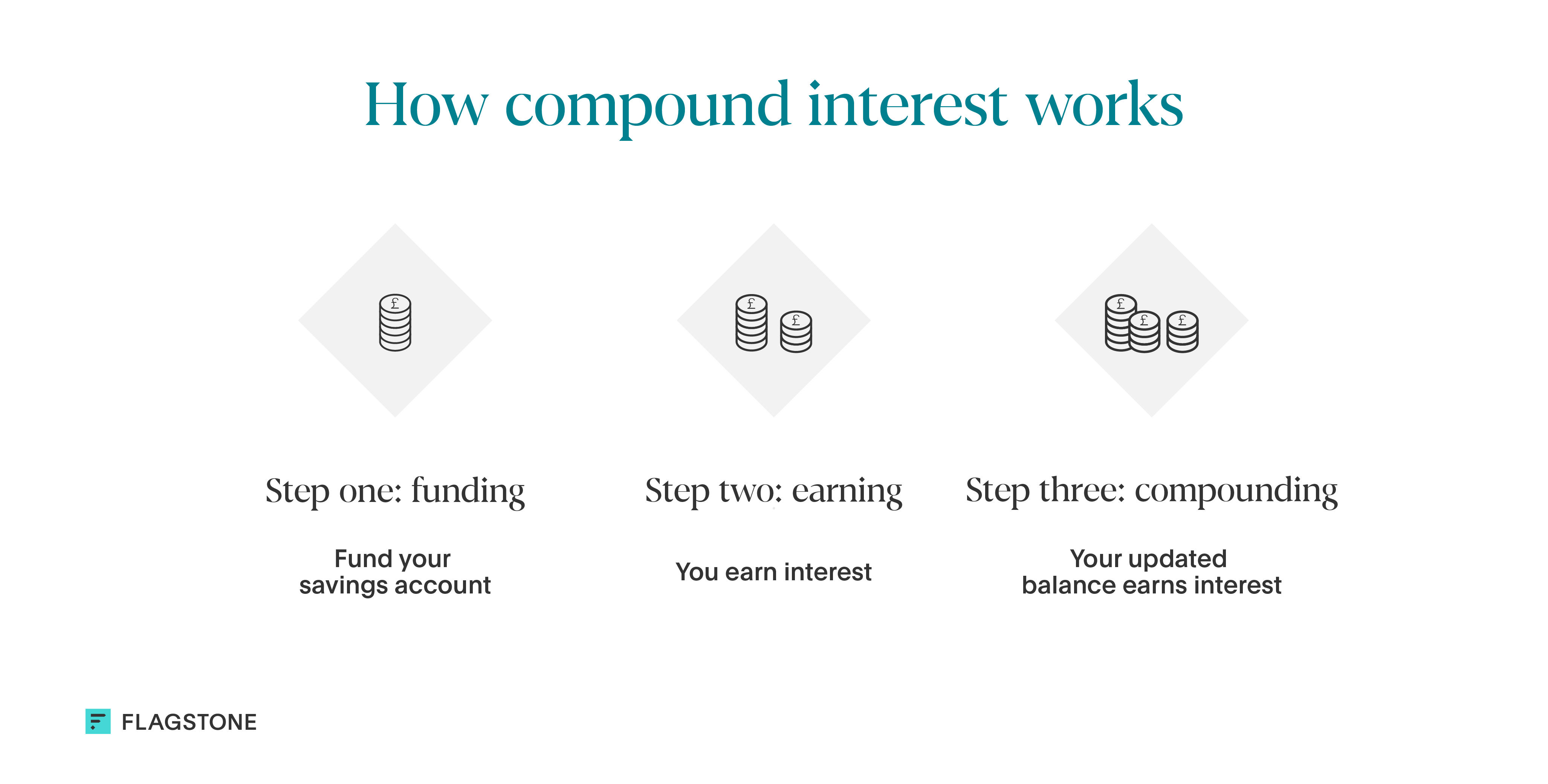

It’s when you earn interest on both the money you’ve saved, and additional interest you accumulate on top. This means that you can earn money at a faster rate over time.

Simple vs. compound interest: what's the difference

Simple interest is a flat sum every time it’s paid. By contrast, the rate of growth for compound interest depends on the size of your deposit. Let’s use an example to demonstrate this.

Compound interest explained with two examples

Ramesh has £10,000 in a savings account. His account has an AER of 5%.

Simple interest example

- Year one: Ramesh earns 5% of £10,000, so he gets an additional £500, for a total of £10,500.

- Year two: Ramesh earns 5% of £10,000, so he gets another £500, for a total of £11,000.

Compound interest example

- Year one: Ramesh earns 5% of £10,000, so he gets an additional £500, for a total of £10,500.

- Year two: Ramesh earns 5% of £10,500, so he gets an additional £525, for a total of £11,025.

The earlier you save, the greater you’ll benefit from compound interest. Before you open a savings account, it can be worth checking how often interest is paid.

If you’re paid interest quarterly or monthly instead of annually, the total amount you’ll receive will be higher.

The formula for compound interest

To estimate the impact that compound interest could have on your savings balance, there’s a calculation you can use.

The formula for calculating compound interest is: P = C (1 + r/n)nt

Let’s break this down:

- ‘C’ refers to the initial deposit

- ‘r’ is the interest rate

- ‘n’ is how regularly your interest is paid

- ‘t’ is how many years your money is invested for

- ‘P’ is the final value of your savings pot

Suppose you invest £5,000 (C) in a savings account that offers a 4.5% (r = 0.045) annual interest rate, compounded quarterly (n = 4), and you plan to leave the money invested for three years (t = 3).

After three years, your initial deposit of £5,000 would grow to £5,718.37 (P) in this scenario.

What are the benefits of compound interest?

Compound interest can be a powerful tool in growing your savings. Here are just some of the benefits of compound interest.

1. Your savings can grow faster

As your savings increase, so does the interest you earn. This continuous cycle has the potential to increase your savings more quickly than they would with simple interest.

2. Long-term growth

The more your savings compound, the more wealth you accumulate. This reiterates the importance of saving as a long-term investment. The earlier you get started, the greater the rewards. Compound interest works in your favour by increasing the value of your savings without any extra effort on your part.

3. Reduces risk

Compound interest can help ride the waves of inflation and economic changes. If your savings don’t grow at the same rate as inflation, the real value of your money diminishes. You may not be able to buy the same amount of goods and services in the future as you could with the same amount of money today. But compound interest can help your funds grow in value, preserving your wealth and enhancing purchasing power. It’s also worth considering factors such as the interest rate, frequency of compounding, and impact of tax.

4. Encourages long-term planning

Understanding the power of compound interest can encourage you to adopt a long-term perspective when it comes to saving and financial goals. Compound interest can motivate you to commit to saving early and often, rewarding you with more interest the longer you save.

Compound your interest at scale to grow your savings

Flagstone’s cash deposit platform offers you access to hundreds of accounts from over 60 banks, including exclusive interest rates.

Spread your cash deposits across different banks, all with one application.