Secure, grow and manage your cash - quickly and simply

Apply for your single Flagstone International account, supported by our expert and trusted client service team. No need to complete paperwork for multiple banks.

Transfer funds from your bank to your Flagstone International account (Minimum £250K or equivalent in available currencies).

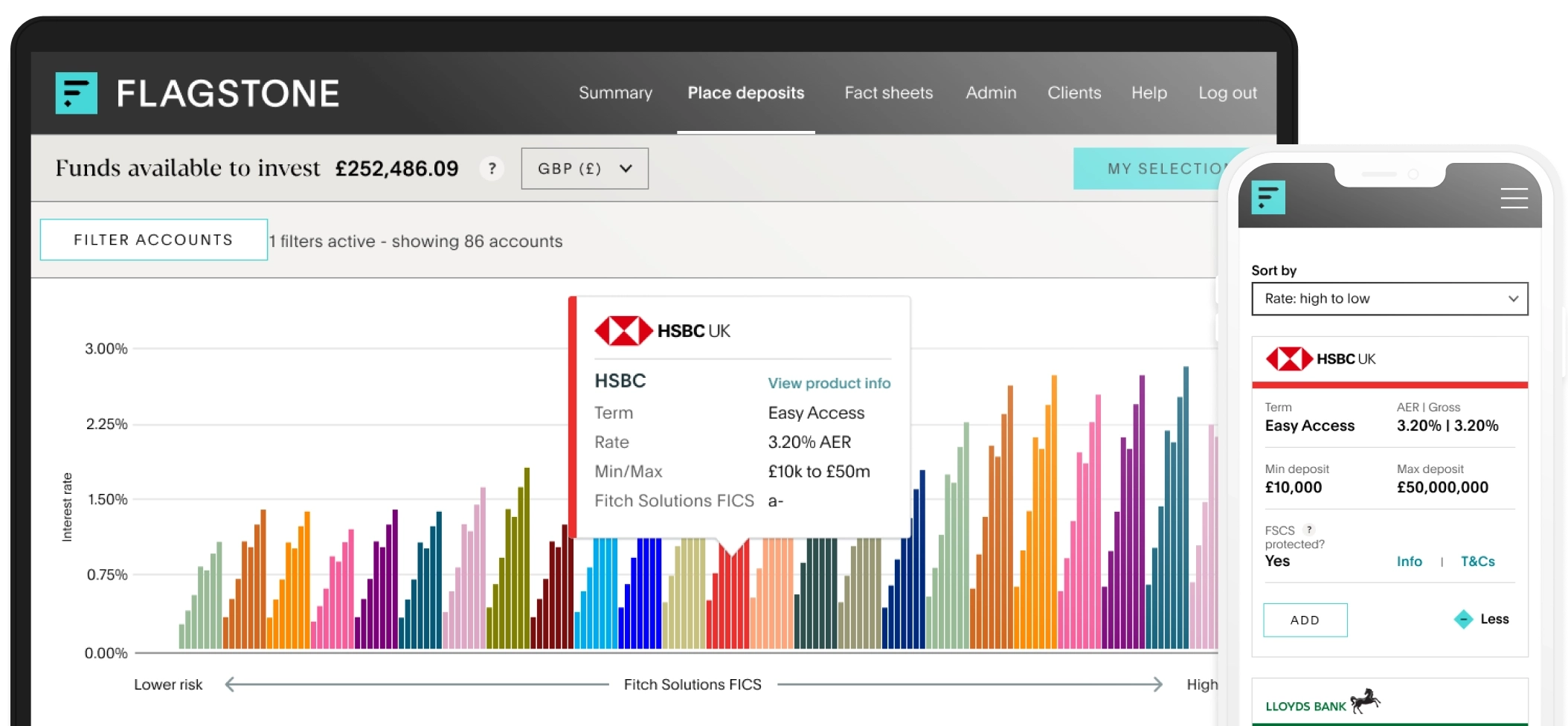

Our platform provides access to a range of competitive accounts from multiple investment grade banks – enabling you to maximise interest and diversify your funds.

Meet changing needs, plans and aspirations with complete visibility of your entire portfolio.

Once your deposits mature, funds are returned to your holding account and then can be withdrawn to your own bank account at any time.

Your money, your way

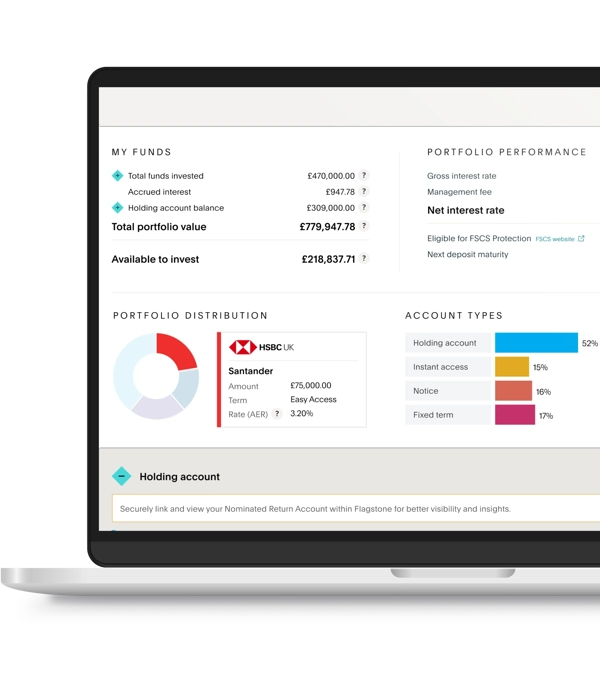

Complete control over your portfolio and immediate visibility of all your money.

Move, place or spread your deposits, 24 hours a day, 7 days a week.

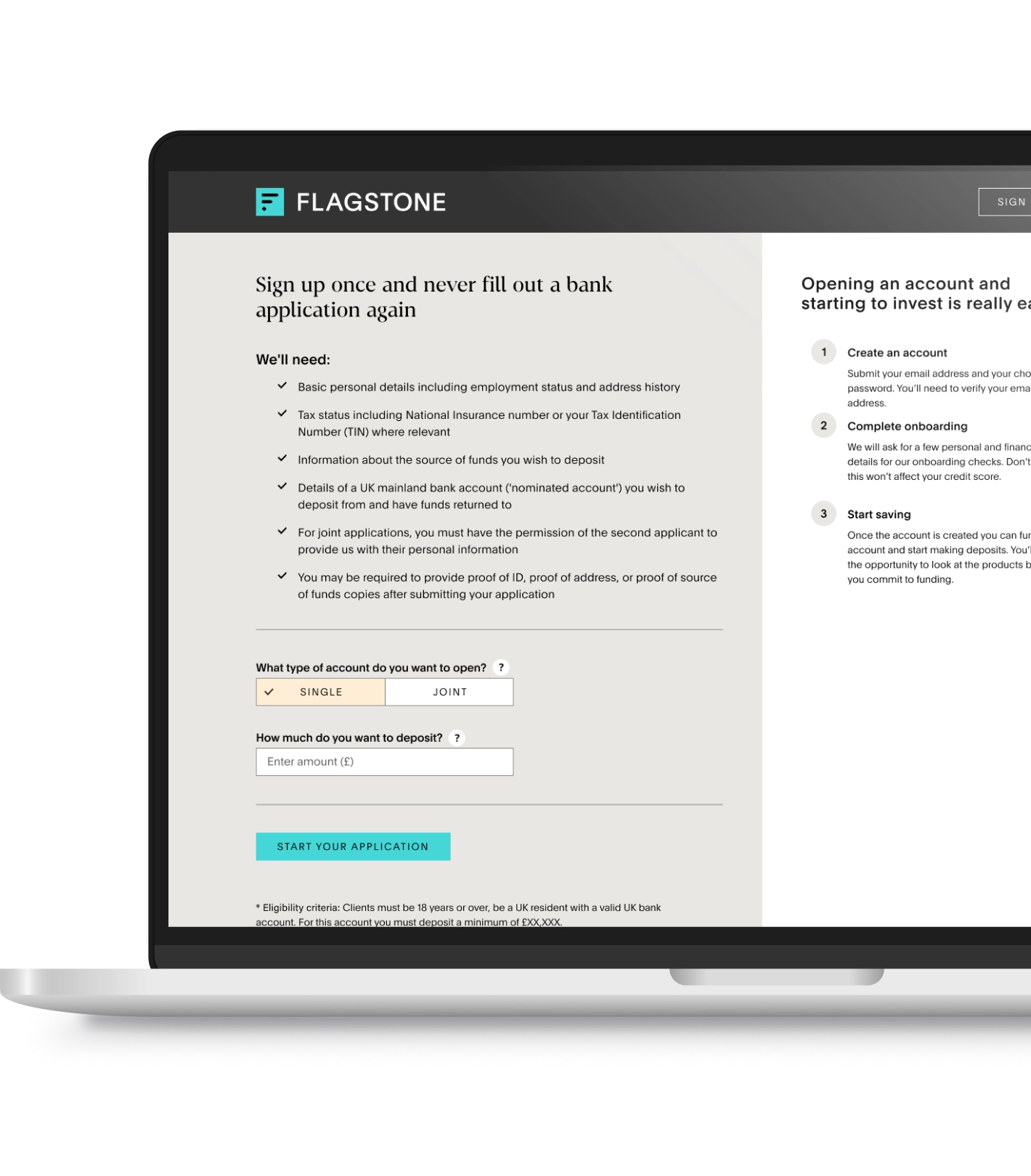

Opening your account

The Flagstone International platform is available to

individual and joint applicants, companies and trusts,

with £250K equivalent or more to deposit.

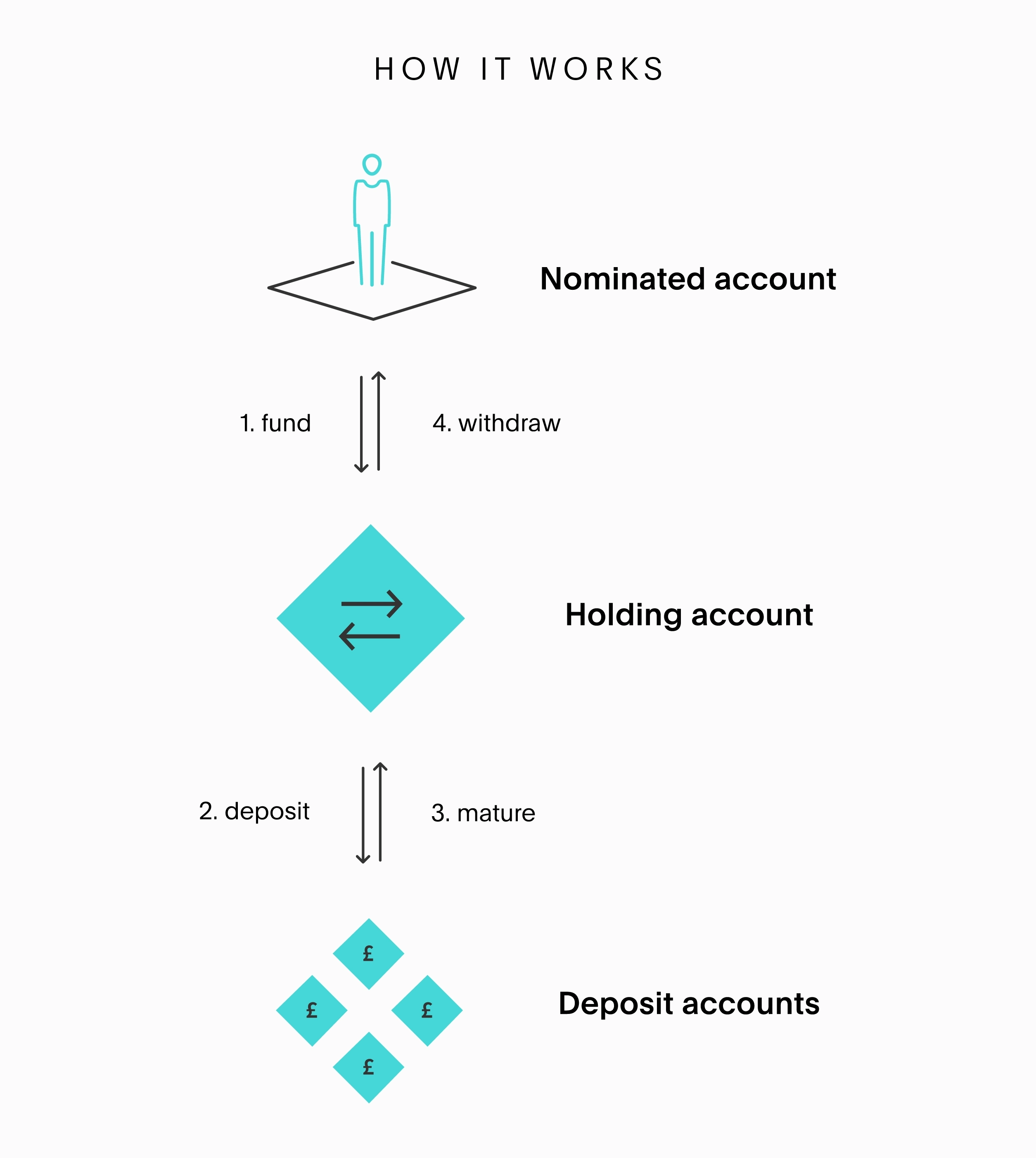

Transferring funds

Once set up, simply transfer funds to your Flagstone

holding account.

Your holding account is set up to receive and hold

your funds before they are transferred to deposit

accounts. Your holding account acts as the account to

which all monies (principal and interest) are returned

at the maturity of a fixed term deposit account, or

when an instant access account or notice account is

closed. Once the matured funds are deposited in your

holding account, you may then withdraw them to your

nominated account, or place them in another deposit

account of your choosing.

The holding account will be provided by HSBC

(Jersey).

Multiple accounts

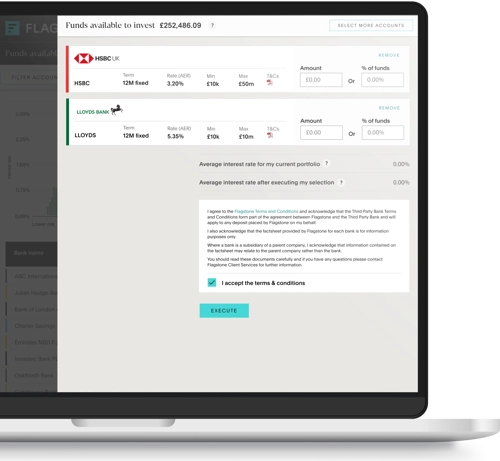

After funding your Flagstone holding account, browse, open and manage as many savings accounts as you need, including instant access, notice and fixed-term accounts.

Complete control

You are in control. Manage your money - quickly and easily - via our highly secure Flagstone platform. Move, place or spread your deposits - 24 hours a day, 7 days a week - with no additional applications to complete.

Peace of mind

Complete visibility of all your money. View

consolidated information across all of your deposit

accounts, including a single tax certificate at the end

of the year.

Make your money work harder.

Open an account with Flagstone International and start growing your money today.

FREQUENTLY ASKED QUESTIONS

Using our platform is simple.

- Apply for one Flagstone International account.

- Move funds from your bank to your Flagstone International

account. - Browse and choose from a range of competitive deposit

products on our online platform. - Spread your money across multiple banks and deposit

products.

As the UK's leading cash deposit platform, the volume of deposits

placed with us, and the relationships developed with our partner

banks gives us access to exclusive deposit rates for our clients.

Our platform provides immediate visibility of all your money,

including consolidated information across all of your cash deposit

accounts, and a single tax certificate at the end of the year.

Flagstone International takes a share of the interest paid by the

bank on each deposit product. The interest rates you see on our

platform already reflect the deduction of any share of interest. For

full details please see our terms and conditions which are

available upon request.

Through a single Flagstone International account, you can use our

secure online platform to open as many deposit accounts with as

many different banks as you require, in just a matter of clicks.

You can complete all these transactions via our online and secure

platform 24/7, without any further paperwork.

No, using the online Flagstone International platform you have full

control of which banks you choose to deposit your money with,

and which accounts you open. Only the client can make decisions

on where the deposits are placed.

When you transfer money to your Flagstone International account,

it is deposited into a ‘holding account’ provided by HSBC (Jersey).

The holding account is a segregated trust account set up to

receive and hold funds before they are sent on to a deposit

account. When a deposit account matures or a request for the

return of instant access or notice account deposits is made, the

funds are returned to the holding account provided by HSBC

(Jersey).

The Flagstone International platform is available to individuals,

corporates, funds and trusts looking to deposit a minimum of

£250K / US$ 250K / EUR 250K.

Ready to get started?

Join Flagstone International and protect the art of

the possible.