Start saving with just £10,000

Open an individual or joint Flagstone account with a minimum deposit of £10,000.

Open an accountCall 020 3745 8130

Open hundreds of accounts from 60+ UK banks, including market-leading and exclusive rates. This is where cash goes to grow.

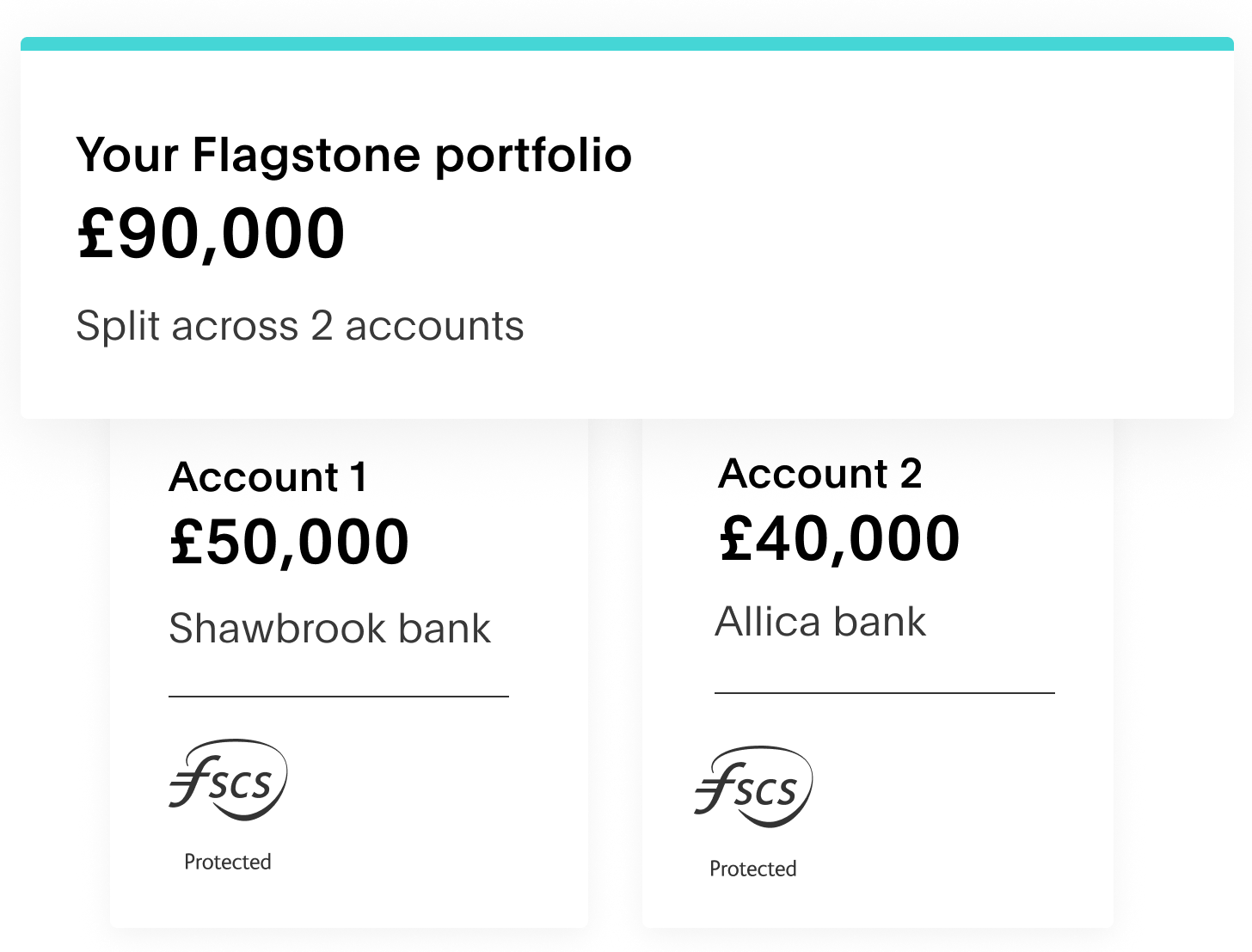

Split your cash between banks, for maximum FSCS protection on your eligible deposits up to £85,000 per banking group. Like a suit of armour for your savings.

Learn more about FSCS ProtectionAccess hundreds of rates with one application, and manage your savings with one password. Arrivederci, admin.

See how it works

The interest rates shown in the illustration have already had our share of interest deducted, so the rate you see is the rate you will receive. You can learn more about our share of interest .

Rates may differ for joint accounts and FSCS protection, where eligible, increases to £170,000. If you are looking to open a joint account, please get in touch with us for an illustration.

If you have specific requirements not covered by our calculator, please contact us for a detailed illustration.

All UK-based banks and building societies on our platform are members of the Financial Service Compensation Scheme. Your eligible deposits are protected up to £85,000 per depositor per UK bank (£170,000 for joint accounts).

Manage your portfolio, maximise your interest, and keep your cash safe and secure. Only with Flagstone.

Apply for your Flagstone account

Start your guided application in just five minutes.

Fund your holding account

We hold your cash in an FSCS eligible HSBC account. You maintain 24/7 access.

Open savings accounts

Deposit your cash into as many savings accounts as you like, with multiple banks – all through Flagstone.

Open an individual or joint Flagstone account with a minimum deposit of £10,000.

Open an account

We work with more banks than any other cash deposit platform. The choice is yours.

A bank

We’re not a bank. Instead, banks list their accounts on our platform – including exclusive rates – to reach more smart savers. Like yourself.

A comparison site

We go beyond comparison. With Flagstone, you can open and manage an entire savings portfolio in one place, with one password.

A wealth adviser

We don’t provide financial advice, but we do make it easy for you to protect, grow, and manage your cash.

For each savings account you open through Flagstone, we receive a small share of the interest. We deduct that share before we feature any savings account on our platform – so the rate you see will always be the rate you receive.

Learn how the FSCS protects your savings, and follow these steps to have financial peace of mind and guarantee your hard-earned cash is covered

Read more →

There are several factors to weigh up when choosing a savings account. We explain which accounts are best suited to your saving needs.

Read more →

Find out how cash deposit platforms work and the benefits they have for savers.

Read more →